Complete Realty Team, a company based in Marietta, GA, is offering several tips for those interested in purchasing a home in 2023. First of all, it is a good idea to work on improving credit score, which plays a significant role in the home financing rate and therefore affects the home buyer’s monthly payments. Second, it is important to set aside a certain percentage of each paycheck to be prepared for the down payment. Third, getting pre-approved can help the home buyer better understand their finances and this can help make them standout when making an offer. Lastly, the home buyer has to prioritize their various wants and needs.

According to recent data from ApartmentList.com, rent prices during the first half of 2021 have been increasing very rapidly with the national rent index rising by 11.4 percent since January. This serves as a motivation for renters to buy their own home. While the higher rent may place too much stress on people’s finances and make it more difficult for them to prepare for homeownership, experts agree that setting aside even small amounts of money and keeping this in a dedicated savings account can be a good starting point for those who dream of having their own home.

People interested in buying a home are also advised by experts to examine their overall finances and credit score and find ways to bring down their debt. The average credit score of first-time home buyers, according to the HUD, is 716. For those who don’t know their credit score, there are several online tools that can help them check their credit score. For those who discover that their credit score is below the above-mentioned average, there are various ways to improve one’s credit score, such as paying bills on time, reducing debit, and using one’s credit card responsibly.

Lastly, it is a good idea to consult with someone who is knowledgeable and experienced with regards to the home market. A trusted advisor can help the home buyer in navigating the specific market and discuss the various available options. Having the appropriate network of real estate and home financing professionals can help the home buyer plan for the home buying process, determine what kind of home is within the budget, and how to get pre-approved.

Ken Mandich, who heads the Complete Realty Team, says, “If you’re planning to be a homeowner one day, the best thing you can do is start preparing now. Even if you don’t think you’ll purchase for a few years, let’s connect today to discuss the process and to set you up for success on your journey to homeownership.”

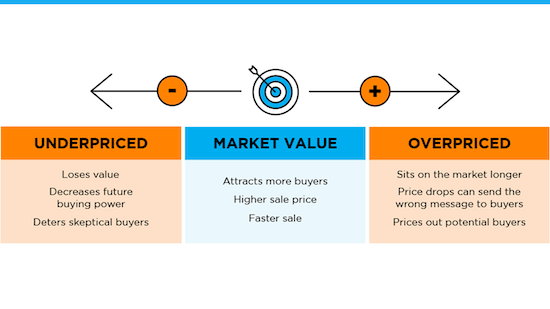

Complete Realty Team has set as its goal to help home sellers and buyers obtain the services of the real estate agents who can really help in ensuring that their clients are comfortable and are well-informed as to what is happening at each step of the home selling or buying process. For home sellers, they will help in developing a personalized and winning strategy for selling the home for as high a price as possible and as quickly as possible. Ken Mandich is a realtor who leads a team of real estate agents and he is also knowledgeable and experienced in digital marketing, which is useful in ensuring that the house of the seller is placed in front of more people who are actively searching for a home to purchase. For home buyers, they will be negotiating the best possible terms. They will also provide the best resources to enable the home buyer to find the best possible home insurance, home financing utilities, and other services.

They provide their residential real estate services in Cobb County, including the surrounding areas of: Fair Oaks, Acworth, Austell, Marietta, Kennesaw, Mableton, Sandy Springs, Powder Springs, Roswell, Smyrna, and Vinings.

https://www.youtube.com/watch?v=ea9DuGJ__zY

Those who are interested in learning more about buying a new home can visit the Complete Realty Team website or contact them through the phone or by email. They can be contacted 24 hours a day, at any day of the week.

Source: Complete Realty Team Offers Tips for Buying a Home in 2023