The most recent news stories about housing prices might be at the forefront of your mind if you're attempting to decide whether or not to sell your property. And if those stories have left you wondering what the impact of this will be on the value of your property, the following is the information that you really need to know.

What Kind of Changes Are We Seeing in Home Prices?

You've probably read news articles that discussed a decline in property values or depreciation in home prices; nevertheless, it's essential to keep in mind that the headlines of those articles are written to create a significant impact with very few words. The problem is that headlines don't often do a very good job of conveying the whole situation.

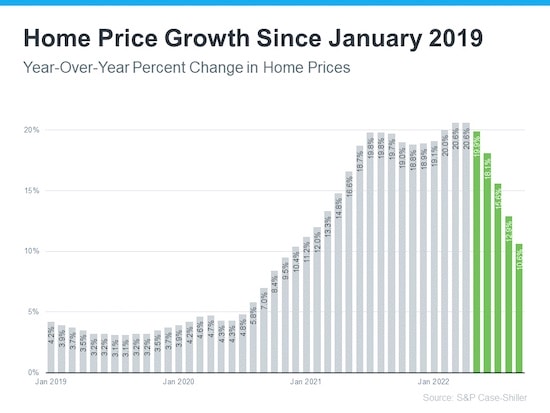

Although there has been a minor month-over-month drop in home prices in some cities, it is still the case that home values have increased on a year-over-year basis across the country. The following graph, which was created with the most recent data available from S&P Case-Shiller, helps tell the tale of what is genuinely occurring in today's housing market:

Home prices have moderated in recent months, as seen in green on the graph, since buyer demand has pulled back in response to rising mortgage rates. This is the topic being highlighted in the news headlines today.

However, the broader picture that extends over a longer period of time is essential to keep in mind. Although the rate of increase in home prices is slowing month-over-month, the percentage of appreciation year-over-year is still significantly higher than the rate of change in home prices that we observed during years in which the market was more typical.

The bars for January 2019 through the middle of 2020 show that the typical annual increase in house prices is between 3 and 4 percent (see bars for January 2019 through mid-2020). However, even the most recent statistics for this year show that costs are still around 8% higher than they were the year before.

What Does This Imply Regarding the Equity in Your Home?

Even though you might not be able to take advantage of the 20% appreciation we saw at the beginning of 2022, the value of your home has increased by an average of 10% over the past year in the majority of markets. A gain of 10% is still significant when compared to the more typical level of appreciation, which is 3-4%.

The big takeaway? It is important that your plans to sell are not derailed by all of the crazy headlines. As a result of the rise in home prices over the past two years, you have probably seen a sizeable increase in your property's equity. You can still use the increase in your equity to help propel your move, even though future trends indicate that property prices will moderate differently depending on the market.

According to the Chief Economist at First American, Mark Fleming, who says:

“Potential home sellers gained significant amounts of equity over the pandemic, so even as affordability-constrained buyer demand spurs price declines in some markets, potential sellers are unlikely to lose all that they have gained.”

Summing It Up

Let's get in touch if you need assistance determining how much equity you have in your present home or if you have concerns about the housing market's current state. You can reach us at 404-410-6465, or just visit our site at CompleteRealtyTeam.com

What Sellers Really Should Know About Home Prices And The News is courtesy of Complete Realty Team. Find more on: The Company’s Site

No comments:

Post a Comment