Ken Mandich from Complete Realty Team is helping Cobb County, Georgia, residents understand the difference between a real estate agent and a REALTOR®. The Cobb County REALTOR® is making a case for why homebuyers and homeowners looking to buy, sell, or rent property should be very discerning when picking someone to represent them as there is a world of difference between the two distinctions.

Ken Mandich from Complete Realty Team is helping Cobb County, Georgia, residents understand the difference between a real estate agent and a REALTOR®. The Cobb County REALTOR® is making a case for why homebuyers and homeowners looking to buy, sell, or rent property should be very discerning when picking someone to represent them as there is a world of difference between the two distinctions.

Real estate agents help clients buy, sell, or rent properties. They must acquire the licenses that their state requires to be able to legally offer real estate buying, selling, and renting services. A REALTOR®, on the other hand, is a term that can refer to several different professions within the real estate industry. A REALTOR® can be a salesperson, a property manager, an appraiser, or even, a real estate broker.

However, REALTOR® is a trademarked term that can only be used by members of the National Association of Realtors (NAR) to refer to themselves. Established in 1908, the NAR is an American trade association that fights for the interests of those who work in the nation’s real estate industry. With 1.5 million members, as of August 2021, it is one of the largest trade associations of its type in the country.

To become a REALTOR®, real estate agents must pass the NAR Code of Ethics course. They should also have a valid real estate license for the state where they are actively engaged in the real estate business, should not have a record of official sanctions due to a history of unprofessional conduct, and should not have filed for a recent or pending bankruptcy.

Ken Mandich talks about what makes collaborating with a REALTOR® for a real estate transaction a safer bet by saying, “Not every real estate agent can become a REALTOR®. Apart from the focused study of the NAR Code of Ethics, you also need to have a successful career wherein you have operated with the NAR’s principles of honesty and integrity. Moreover, to become a REALTOR® you also need to pay an annual fee. Most real estate agents who are not pursuing a NAR membership just don’t make enough money to justify its cost. Would you trust the validity of your multi-million-dollar property deal to someone who does not get enough clients to justify that nominal cost? We, who have served the real estate industry for years, treat the REALTOR® trademark as a badge of honor. In short, as a property owner or buyer, finding out whether a real estate professional is a REALTOR® is a simple litmus test to quickly determine whether their skills are up to acceptable standards. If you are looking for help with buying, selling, or renting a property in Cobb County, we urge you to reach out to us here at Complete Realty Team. Our team of experienced REALTORS® will help you streamline your real estate purchase and make the entire process seamless and hassle-free. Visit https://crt.homes/0ux5 to find out more.”

One of the primary ways to determine whether a REALTOR® is a right fit for a property owner or buyer is to determine whether they have enough experience buying and selling properties in that region. A REALTOR® who has worked diligently in Cobb County for several years, such as Ken Mandich, is the best partner one can have when closing a deal in Acworth, Austell, Fair Oaks, Kennesaw, Mableton, Marietta, Powder Springs, Roswell, Sandy Springs, Smyrna, and Vinings. An experienced REALTOR® will also go above and beyond to help their client find the right home or to find the right buyer who is willing to pay top dollar for their property. A professional REALTOR® will also assume responsibility for all the paperwork as they have extensive experience with the state’s laws and regulations when it comes to real estate transactions.

Cobb County readers looking to buy or sell property can contact Ken Mandich using the contact information available at https://g.page/realtorken?share.

Source: Ken Mandich From Complete Realty Team Is Educating Homeowners On Exactly What A Realtor Does

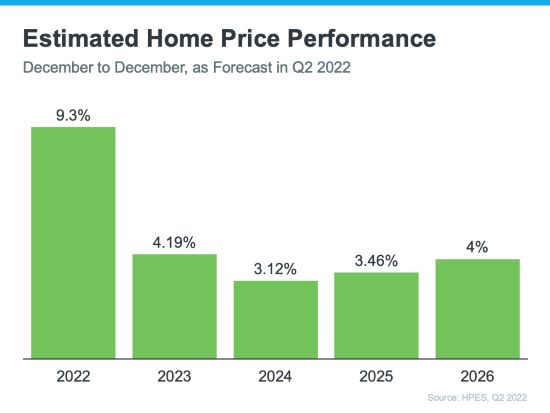

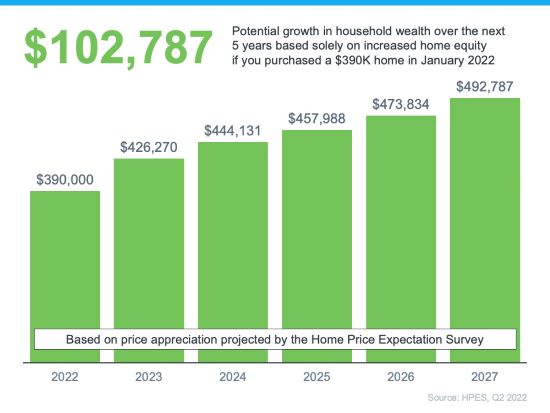

Ken Mandich, a real estate agent from Cobb County, Georgia, is easing fears that the current housing market is headed for a crash similar to the one in 2008.

Ken Mandich, a real estate agent from Cobb County, Georgia, is easing fears that the current housing market is headed for a crash similar to the one in 2008.