If you are concerned about the latest news of foreclosures rising in the U.S. it’s important to put it into the correct context. Check out this video to learn more:

You’re not the only one if you’ve read recent news regarding the rise in foreclosures in the housing market. The tales in the media can, without question, be somewhat perplexing at the moment. They might even cause you to reconsider buying a house out of concern that the market might crash. Many people want to know the truth about what is happening right now. In that case, it is imperative to comprehend what the data actually means when it indicates that a foreclosure catastrophe is not where the market is headed. Let’s take a closer look.

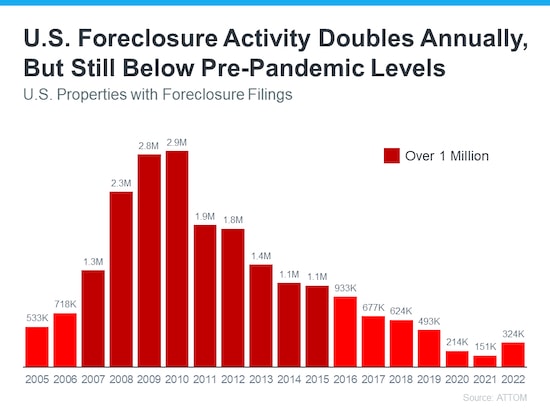

Foreclosure filings are up 115% from 2021 but down 34% from 2019, according to ATTOM’s Year-End 2022 U.S. Foreclosure Market Report. Putting this 115% surge in context is more crucial than ever as media headlines focus solely on this number.

Although the number of foreclosure files more than doubled last year, it’s essential to keep in mind why this occurred and how it relates to the market’s more typical pre-pandemic years. Foreclosure filings were at record-low levels in 2020 and 2021 as a result of the forbearance program and other homeowner relief alternatives, so any increase last year is — unsurprisingly — a surge up. According to ATTOM’s Executive VP of Market Intelligence, Rick Sharga:

Eighteen months after the end of the government’s foreclosure moratorium, and with less than five percent of the 8.4 million borrowers who entered the CARES Act forbearance program remaining, foreclosure activity remains significantly lower than it was prior to the COVID-19 pandemic. It seems clear that government and mortgage industry efforts during the pandemic, coupled with a strong economy, have helped prevent millions of unnecessary foreclosures.

These choices undoubtedly allowed millions of homeowners to remain in their properties, enabling them to rebuild their lives at a very trying time. Due to rising property values at the same time, many homeowners who might otherwise have faced foreclosure were able to use their equity and sell their homes instead, and this pattern is still present today.

Furthermore, keep in mind that today’s foreclosure rates are significantly lower than the record-breaking 2.9 million that were recorded in 2010 during the housing market meltdown, as shown in the graph below.

Even though the number of foreclosures is increasing, perspective is essential. Founder and Author of Calculated Risk Bill McBride recently noted:

The bottom line is there will be an increase in foreclosures over the next year (from record low levels), but there will not be a huge wave of distressed sales as happened following the housing bubble. The distressed sales during the housing bust led to cascading price declines, and that will not happen this time.

Summing It Up

Contextualizing the data is more crucial than ever right now. Although there is a projected increase in foreclosures in the housing market, they are still well below the crisis levels experienced when the housing bubble burst so that home prices won’t fall.

If you have questions about the housing market, don’t hesitate to get in touch. You can reach us at 404-410-6465 or visit CompleteRealtyTeam.com.

Original post here: There Is No Reason To Fear A Wave Of Foreclosures In 2023

No comments:

Post a Comment