Thursday, June 29, 2023

A Recession Doesn't Mean The Housing Market Will Crash

Historically a recession usually helps with interest rates dropping!

Wednesday, June 28, 2023

The Benefits of Pre-Sale Home Updates and Top 4 Projects with the Best ROI

Hello there! It’s well-known that making just a few updates and improvements to your home can drastically enhance its value, potentially helping it sell faster and at a better price. Not all updates are created equal, though, so we did some homework for you and compiled our top five home improvement projects with the greatest ROI – some may surprise you! Here’s a quick video explaining why you should go ahead and do some updating before listing:

Benefits of Home Updates Before Selling

Let’s consider the advantages of updating your house before placing that “For Sale” sign on the lawn. First, trying to modernize can act like a magnet for potential buyers who visit. Imagine walking into your house to find it looking like something out of the 80s versus a modern space with sleek modern vibes? Yeah, me too! Not only are aesthetic updates attractive, they can also significantly raise it’s value. Investment in home improvements doesn’t amount to wasted money; instead, it can become an even more significant return when selling. And updating your house may even speed up the sale process – seemingly too good to be true? Not really; plenty of stories exist about homes that underwent quick makeovers, leading to them selling quickly. So giving your property some TLC before selling could really pay off!

Understanding ROI in Home Improvement Projects

Let’s first ensure we’re clear on the Return On Investment (ROI) concept. Simply put, ROI refers to what a return will look like from what was invested. A real estate appraisal is all about adding the greatest possible value with home improvements that exceed what they cost you. There’s no magic formula for what will yield the greatest return on investment – it depends on various factors, like your home’s current state, housing market conditions and trends in home design. But don’t let that discourage you – with careful planning and an informed approach, you can select updates that provide maximum return while leaving you smiling all the way back home – all it takes is forethought and selecting upgrades that offer the greatest value to maximize return on investment!

Here Are Four Home Improvement Projects with the Highest ROI

Without further ado, here are four projects with the most significant return on investment!

Minor Kitchen Remodel

- Let’s break down what a minor kitchen remodel entails. No, you don’t need to rip everything out and start from scratch; instead, consider more limited changes like painting cabinets with fresh coats of paint, switching out hardware for upgraded models, or upgrading countertops or appliances to energy-saving versions – giving what’s already there some TLC is far less of a headache. At the same time, your wallet won’t feel it quite so strongly!

- And what’s truly amazing? Kitchen refreshes can pay for themselves handsomely when selling the property; potential home buyers prioritize having a modern-looking kitchen when making their decisions, often paying extra to acquire one that’s move-in ready. So while you might just think it would be nice to finally replace that avocado-green fridge, these projects actually increase your odds of realizing more when it’s time to sell – creating an all-win scenario!

Bathroom Update

- Now let’s move on to updating the bathroom. When people visit in the morning and at night, people want their space to be pleasant! Potential improvements include fresh paint or new fixtures such as modern faucets or showerheads, replacing outdated lighting with more contemporary options and possibly upgrading vanity furniture as well. And for something really adventurous, try tiling either the floor or shower area; these changes don’t need to break the bank but can significantly elevate your bathroom!

- Return On Investment of Bathroom Updates can be Remarkable! It’s clear: Everyone appreciates a beautiful, modern bathroom! An upgraded space can draw buyers in quickly, leading to higher selling prices for your home and creating even minor bathroom updates as a worthy investment – as is often said, kitchens and bathrooms sell houses!

Exterior Improvements (Siding, Paint & Landscaping)

- Let’s step outside for a moment and discuss external home improvements. Your curb appeal is often the first thing buyers see, so making improvements that increase it is absolutely crucial to creating a welcoming space that attracts buyers. You can do plenty to give it that pop, from painting over chipped surfaces or replacing worn-out siding to power washing off grime off and adding fresh flowers. Don’t forget about landscaping either: well-manicured gardens, new mulch and tidy lawns make a significant impactful statement about what buyers see first when viewing properties; while giving your front door some TLC can create instantaneous appeal and draw them in with its welcoming personality and appeal – perfect when making first impressions count when potential buyers first see it.

- External improvements can make a remarkable impactful on home value and ROI. Imagine this: when buyers pull up to your house, its exterior serves as their first impression and, if it appeals to them, could open doors to more interested buyers and potentially a quicker sale at a higher sales price. Making the exterior of your house more inviting from day one won’t just increase interest; investing in making it more appealing can mean a faster sale as well.

Adding a Home Office

- Our work environment has undergone dramatic change, and now having a home office is less of a luxury and more of an essential. More people than ever work remotely and need somewhere dedicated for focus and Zoom calls; even small nooks with good lighting will do. It is crucial to create an atmosphere where folks can visualize themselves delivering big presentations right from their homes!

- Now let’s consider numbers. Adding a home office may seem like a significant undertaking, but it could pay dividends when selling your house. As remote work has become more widespread, homes with office spaces have become coveted properties, often selling for more than those without. Yes, investing money to create an effective work-from-home space might require spending some cash up front, but with demand outpacing supply, you might see an excellent return when selling! It is an investment worth taking seriously!

Summing It Up

Let’s bring this discussion full circle now. We have discussed how making key upgrades before listing your home can draw in more prospective buyers, raise your selling price, and hasten its sale process. Certain projects can significantly boost your return on investment (ROI) from cosmetic updates to creating an introspective home office space. But remember: smart decisions with regard to upgrades will yield maximum return for your dollar spent. Before you tear out tile or start choosing paint colors, take a moment to consider which upgrades will add the most value to your home. With some careful planning and smart upgrades in place, your next real estate transaction could become a smashing success! Here’s to making that real estate transaction successful and profitable!

If you are looking to buy or sell a home in Cobb County or the Metro Atlanta area, or just have questions – get in touch! You can reach us at (404) 410-6465 or visit CompleteRealtyTeam.com to learn more or contact us by email.

Original post here: The Benefits of Pre-Sale Home Updates and Top 4 Projects with the Best ROI

Townhouse | Home For Sale In Acworth GA | 2 Bedroom - 2.5 Bath | Offered At $29...

Close to downtown Acworth and Lake Allatoona!

Tuesday, June 6, 2023

Should You Get A Home Inspection Before Selling?

Should I Have An Inspection Done On My House Before I Sell It?

In the complicated process of selling a home, many things come into play that can have a big effect on how well the sale goes and how much money the seller makes. A pre-sale home check is one of these factors that sellers often forget or don’t give enough thought to. As the name suggests, a pre-sale home inspection is a thorough look at the state of your property by a trained professional before you put it on the market.

Traditionally, this was the buyer’s job. The goal was to find problems that weren’t obvious and ask for repairs or lower prices. But things are changing because more and more sellers are doing their own checks. A pre-sale home inspection can give you important information about your property, giving you an edge when it comes to price, negotiating, and making the property more marketable in general. But, like any other strategic choice, it has both pros and cons. This article goes into detail about pre-sale home inspections, which will help you decide if it’s a good idea for your situation.

What Is A Home Inspection Before The Sale?

A home inspection before the sale is also known as a pre-sale home inspection.

So what does a pre-sale home inspection mean?

A pre-sale home inspection, also called a seller’s inspection or listing inspection, is a thorough look at the state of a property by a certified home inspector before it goes on the market. The goal of this process is to find any problems that could make it hard to sell the house or lower its value.

A short description of what it means:

During a typical pre-sale home inspection, all of the home’s major systems and structural parts are looked at in depth. This includes, but is not limited to, the roof, foundation, heating and cooling systems, plumbing and electrical systems, windows and doors, and the house’s general structural integrity. It is also often necessary to check for bugs or insect damage, such as from termites. If the property has a swimming pool or a septic system, these may also be checked. Depending on the size and state of the land, the inspection can take several hours.

At the end of the inspection, the home inspector will give you a detailed report that lists any problems he or she found, generally grouped by how bad they are and how much it is expected to cost to fix or replace them. There may also be photos and ideas for things that need to be repaired around the home.

What home inspectors do:

When a house is being sold, the home inspector is a very important part of the process. As neutral third parties, they look at the condition of a place and write a report about it. Their goal is to find problems that aren’t obvious and give a fair, accurate picture of the home’s state.

Certified house inspectors have gone through extensive training and follow a code of ethics. This makes sure that their inspections follow standard rules and that their reports are accurate and full of details. It’s important to remember that home inspectors do not give a house a pass or fail score. Instead, they give a snapshot of its current state and let the sellers and possible buyers decide what to do.

Pros of a Home Inspection Before Sale

A pre-sale home inspection gives buyers a number of clear benefits that can speed up the selling process and possibly make the home worth more on the market. By doing this, sellers can do a lot to boost buyer trust and reassure potential buyers about the property’s condition. When problems are found and fixed before the buyer’s review, surprises that could kill the deal don’t happen. Also, sellers can make their home more appealing to buyers by fixing problems before putting it on the market. Pricing-wise, a clean pre-sale inspection report or a clear promise to fix problems can be used to support a higher asking price. Lastly, a good pre-sale inspection can speed up the selling process because buyers may decide not to do their own inspection or because negotiations may go more quickly after the inspection. Basically, a pre-sale home inspection can give buyers an edge in the market, which can lead to a successful and profitable home sale.

- Boosting the confidence of buyers – A home inspection before a sale can give buyers a lot more trust. When potential buyers see that a house has already been inspected and any repairs that were needed have been done, it gives them peace of mind about the house’s state. This openness can build trust and make buyers feel better about their decision to buy.

- Making the buyer’s inspection less surprising – Often, deals fall through or get put off because the buyer’s review turns up surprises. By doing a pre-sale check, sellers can find problems and fix them before the sale. This makes it less likely that the buyer will find something bad that could stop the sale.

- Fixing problems before putting the house on the market – When problems are found early, buyers have time to fix or improve the property before putting it on the market. This makes the house more appealing to buyers and can also keep the deal from having to be renegotiated if problems are found during a buyer’s review.

- Giving them a price advantage – A pre-sale check can help sellers set better prices. If the inspection report comes back clean or if the seller fixes any problems that were found, it can be a good reason for the seller to ask for a higher price. On the other hand, if buyers choose not to fix certain problems, they can include the cost of fixing them in the price, which makes the price listed more clear and reasonable.

- Making the selling process go faster – When the pre-sale check goes well, it can speed up the process of selling. Buyers may decide not to do their own inspection, or at the very least, talks can go much more smoothly after the inspection. This can speed up the sale process as a whole.

Cons Of A Home Inspection Before A Sale

A pre-sale home inspection can be helpful in many ways, but it can also be bad in some ways. One drawback that stands out is the cost. Home inspections can be expensive, and the seller has to pay for this cost up front. Also, a pre-sale check could find major problems that the seller has to tell any potential buyers about, even if they don’t want to fix them. This could turn off potential sellers or make the home seem less valuable. Also, if big problems are found, fixing them can make it take longer to put the home on the market. Even if there is a pre-sale inspection, a buyer could still choose to do their own inspection, which could find more problems. So, a pre-sale inspection can bring clarity and trust, but it can also bring up issues that sellers need to think about.

- Costs of a home inspection before the sale – One of the main problems with a pre-sale home inspection is that it costs money. Depending on how big the house is and where it is, a professional inspection can cost anywhere from a few hundred to more than a thousand dollars. This is a cost that the seller has to pay up front, and there is no promise that it will lead to a higher selling price or a faster sale.

- The risk of finding problems that the seller must tell you about – Another possible downside is that the seller might find out about major problems that they didn’t know about before. Once these problems are found during an inspection, the seller is required by law to tell potential buyers about them. This could stop some people from buying or make them give less, especially if the problems are big and the seller doesn’t want to fix them.

- Possible delays if there are major problems – If the pre-sale inspection finds big problems, like structural problems, the house may need a lot of work. These fixes can take time, which could put off putting the house on the market. In a hot market where time is of the essence, this wait could be a big problem.

- The chance that buyers will want a second inspection – Even if the seller has already done a pre-sale check, the buyer may still want to do their own. If the buyer’s inspection finds more problems than the pre-sale inspection did, it could lead to new talks or even put the sale at risk.

Summing It Up

In conclusion, a pre-sale home check could have both pros and cons that homeowners should think about. On the plus side, it can boost buyer trust, make sure there aren’t any surprises during the buyer’s inspection, let problems be fixed before the house goes on the market, give you a price advantage, and maybe even speed up the selling process. But there are costs and the chance of finding problems that the seller needs to tell you about. In some situations, if serious problems are found, it could cause delays, and buyers could always ask for a second inspection. Whether or not to do a pre-sale home inspection rests a lot on the seller and the property. This includes the condition of the home, the local real estate market, and the seller’s finances. Even though it can be helpful in some cases, it’s not a sure thing for every seller. Before making a choice, it’s best to talk with real estate professionals who know the local market and can give you personalized advice. They can tell you if a pre-sale home inspection is likely to help you in your situation.

Original post here: Should You Get A Home Inspection Before Selling?

Wednesday, March 29, 2023

Buying An Old House vs New House

Should you buy a newly built house or one that has been previously lived in? Check out the advantages of both in this new video:

There is no doubt that the financial benefits of selling a house are excellent today. If you’re ready to make a move, now is a wonderful time to list. Yet, if you do sell your home right now, you may be wondering where you will live when you relocate.

With so few properties on the market right now, you may be thinking about building a new home as one of your possibilities. Yet, you may wonder if it is your best option. Let’s weigh the advantages of buying a new house against buying an existing one, and why engaging with a real estate agent throughout the process is crucial to your success no matter what you choose.

The Benefits of Freshly Constructed Houses

First, consider the advantages of owning a newly built home. You’ll be able to do the following with a brand-new home:

1. Make Your Dream House A Reality – When you build a house from the ground up, you can choose the specific desired features, such as appliances, finishes, landscaping, layout, and more.

2. The Latest In Energy Efficiency – You can choose energy-efficient options when designing a home to help minimize your electricity expenses, protect the environment, and reduce your carbon footprint.

3. Reduce The Need For Repairs & Updates – All home builders provide warranties, giving you peace of mind that your new home should be trouble free for years to come. You will also have fewer small or large projects to complete. QuickenLoans puts it this way:

Buying a new construction vs. existing home typically means you’ll have fewer repairs to do. It can be a huge relief to know that it’s unlikely you’ll have to repair the roof or replace the furnace.

4. Everything Is Brand New – Another advantage of a new home is that nothing in it is used. Everything is completely new and distinctively yours from the start.

The Benefits of Existing Houses

Let’s compare that to the benefits of purchasing an existing property. You can do the following with an existing home:

1. Find A Wider Range Of Home Types & Floorplans – You’ll have a more comprehensive selection of floorplans and designs to choose from with decades of homes to choose from.

2. Join A Well Established Community – Existing homes allow you to get to know the neighborhood, community, or traffic patterns before making a commitment.

3. Established Landscaping And Older Mature Trees – Established neighborhoods also feature better-developed landscaping and trees, which can provide you with more seclusion and curb appeal. According to Investopedia, if you buy an existing home:

Odds are, too, that the home will have mature landscaping, so you won’t have to worry about starting a lawn, planting shrubs, and waiting for trees to grow.

4. Enjoy That Lived In Charm – The character of older dwellings is challenging to replicate. You may select an existing home if you value timeless craftsmanship or design characteristics. According to the website Houseopedia:

Charm is priceless. Existing homes, especially those built in the 1950’s or before, often offer architectural elements, historic charm and a quality of craftsmanship not available in new homes.

You do have options. When you begin your search for the ideal home, keep in mind that you can go either way; you simply need to pick which features and benefits are the most essential to you. Partnering with your trusted real estate expert and agent will help you make the most informed and educated decision possible, allowing you to move into the home of your dreams.

Summing It Up

If you have any questions about the alternatives in your area, let’s talk about what’s available and what’s best for you so you can confidently make your next move. Just visit CompleteRealtyTeam.com to contact us by email or give us a call at 404-410-6465 anytime.

Original post here: Buying An Old House vs New House

Tuesday, March 21, 2023

Do You Have Questions About The Housing Market? We’re Here To Help!

Are you confused by all the headlines on the real estate market?

If you’re considering buying or selling a home, you’re undoubtedly curious about what’s going on with home prices, mortgage rates, housing availability, and other factors. Given how sensationalized today’s headlines are, this is no simple assignment. According to Jay Thompson, a Real Estate Industry Consultant:

Housing market headlines are everywhere. Many are quite sensational, ending with exclamation points or predicting impending doom for the industry. Clickbait, the sensationalizing of headlines and content, has been an issue since the dawn of the internet, and housing news is not immune to it.

Regrettably, when information in the media is unclear, it can cause market panic and confusion. According to Jason Lewris, Cofounder and Chief Data Officer at Parcl:

In the absence of trustworthy, up-to-date information, real estate decisions are increasingly being driven by fear, uncertainty, and doubt.

But this does not have to be the case. Buying or selling a house is a huge choice that should be made with confidence. Use a local real estate advisor to help you differentiate fact from fiction and obtain the answers you need and are looking for.

Your best resource for understanding what’s going on at the national and local levels is a trustworthy real estate expert. They’ll be able to debunk the headlines using reliable data. And utilizing their extensive industry experience, they’ll provide context so that you understand how current patterns compare to the sector’s usual ebbs and flows, historical statistics, and more.

They’ll then inform you if your local area is following the national trend or if they’re observing something different in your market to ensure you have a complete picture. You’ll then be able to utilize all of that information together to make the best selection for you.

After all, moving is a potentially life-changing event. It should be something that you are both prepared for and excited about. This is where a top rated real estate agent comes in.

In Conclusion

If you have any questions regarding the news or what’s going on in the housing market right now, let’s talk so you can get expert perspectives and assistance. You can reach us at 404-410-6465 or visit our site at CompleteRealtyTeam.com.

Original post here: Do You Have Questions About The Housing Market? We’re Here To Help!

Friday, March 17, 2023

Is It Better To Rent Or Buy A House

Are you facing the decision of whether or not to rent or buy a house this year? If so, check out this video that will help you decide if it’s better to rent or buy a house:

If you rent, you probably have to make a big decision every year: do you keep the same lease, start a new one, or buy a home? This year is the same. But before you get too deep into your choices, it helps to know how much renting really costs.

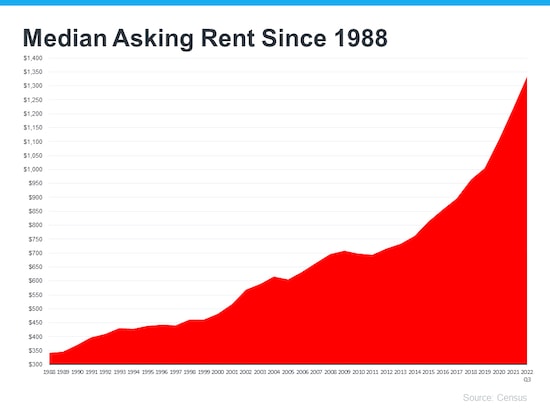

Based on information from realtor.com, both current renters and new renters have seen their rent go up in the past year:

Three out of four renters (74.2%) who have moved in the past 12 months reported seeing their rent increase. The strain from recent rent hikes isn’t exclusive to renters who have recently moved. Nearly two-thirds of renters (63.2%) who have lived in their current rental between 12 and 24 months, and likely renewed their lease, have also reported increases in their rent.

And if you look at the past, you shouldn’t be surprised by that. The Census says that rents have been going up pretty steadily since 1988 (see graph below):

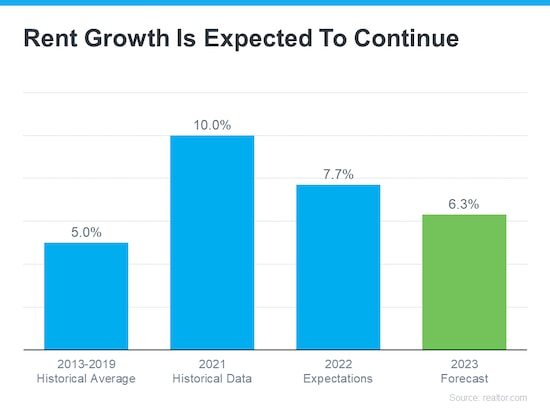

So, if you’re thinking about renting in 2023, you should think about whether this trend is likely to continue. Realtor.com’s 2023 Housing Forecast says that rents will keep going up (see graph below):

This prediction says that rents will go up by 6.3% in the coming year (shown in green). When you look at the blue bars on the graph, it’s clear that the 2023 projection doesn’t call for an increase as big as the ones renters have seen in the past two years, but it’s still higher than the average rent increase between 2013 and 2019. So, if you want to rent again this year but haven’t renewed your lease yet, you may have to pay more when you do.

With Rising Rents, Homeownership Is An Excellent Alternative

With prices going up, you may want to think about what other options you have. If you want more stability, you might want to put buying a home at the top of your list. One of the many benefits of owning your own home is that you can lock in a stable monthly payment for as long as your loan lasts. As Freddie Mac says:

Monthly rent payments may increase over time, but a fixed-rate mortgage will ensure that you’re paying the same amount each month. With a fixed-rate mortgage, your interest rate is locked in for the life of loan. Steady payments allow you to budget wisely and make plans for the future.

If you plan to move this year, locking in your monthly housing costs for the length of your loan can be a big help. You won’t have to worry about whether you need to change your budget to account for annual increases, like you would if you left your housing payment up to your landlord and their renewal cycle.

Homeowners also have a lot more equity in their homes, which has grown a lot the last few years. In fact, CoreLogic’s most recent Homeowner Equity Insight report shows that the average homeowner gained $34,300 in equity over the past year. As a renter, the money you pay goes only toward the cost of your home and in the landlord’s pocket. When you pay your mortgage on a house, you automatically save money, which adds to your wealth. This is called your home equity.

Summing It Up

If you want to rent this year, it’s important to think about how much it will really cost you. Let’s talk about how you can start getting ready to buy a home today.

If you’re ready to start your journey as a homeowner, get in touch! Give us a call at 404-410-6465 or visit CompleteRealtyTeam.com to contact by email.

Original post here: Is It Better To Rent Or Buy A House

Monday, March 13, 2023

Complete Realty Team Offers Tips for Buying a Home in 2023

Complete Realty Team, a company based in Marietta, GA, is offering several tips for those interested in purchasing a home in 2023. First of all, it is a good idea to work on improving credit score, which plays a significant role in the home financing rate and therefore affects the home buyer’s monthly payments. Second, it is important to set aside a certain percentage of each paycheck to be prepared for the down payment. Third, getting pre-approved can help the home buyer better understand their finances and this can help make them standout when making an offer. Lastly, the home buyer has to prioritize their various wants and needs.

According to recent data from ApartmentList.com, rent prices during the first half of 2021 have been increasing very rapidly with the national rent index rising by 11.4 percent since January. This serves as a motivation for renters to buy their own home. While the higher rent may place too much stress on people’s finances and make it more difficult for them to prepare for homeownership, experts agree that setting aside even small amounts of money and keeping this in a dedicated savings account can be a good starting point for those who dream of having their own home.

People interested in buying a home are also advised by experts to examine their overall finances and credit score and find ways to bring down their debt. The average credit score of first-time home buyers, according to the HUD, is 716. For those who don’t know their credit score, there are several online tools that can help them check their credit score. For those who discover that their credit score is below the above-mentioned average, there are various ways to improve one’s credit score, such as paying bills on time, reducing debit, and using one’s credit card responsibly.

Lastly, it is a good idea to consult with someone who is knowledgeable and experienced with regards to the home market. A trusted advisor can help the home buyer in navigating the specific market and discuss the various available options. Having the appropriate network of real estate and home financing professionals can help the home buyer plan for the home buying process, determine what kind of home is within the budget, and how to get pre-approved.

Ken Mandich, who heads the Complete Realty Team, says, “If you’re planning to be a homeowner one day, the best thing you can do is start preparing now. Even if you don’t think you’ll purchase for a few years, let’s connect today to discuss the process and to set you up for success on your journey to homeownership.”

Complete Realty Team has set as its goal to help home sellers and buyers obtain the services of the real estate agents who can really help in ensuring that their clients are comfortable and are well-informed as to what is happening at each step of the home selling or buying process. For home sellers, they will help in developing a personalized and winning strategy for selling the home for as high a price as possible and as quickly as possible. Ken Mandich is a realtor who leads a team of real estate agents and he is also knowledgeable and experienced in digital marketing, which is useful in ensuring that the house of the seller is placed in front of more people who are actively searching for a home to purchase. For home buyers, they will be negotiating the best possible terms. They will also provide the best resources to enable the home buyer to find the best possible home insurance, home financing utilities, and other services.

They provide their residential real estate services in Cobb County, including the surrounding areas of: Fair Oaks, Acworth, Austell, Marietta, Kennesaw, Mableton, Sandy Springs, Powder Springs, Roswell, Smyrna, and Vinings.

https://www.youtube.com/watch?v=ea9DuGJ__zY

Those who are interested in learning more about buying a new home can visit the Complete Realty Team website or contact them through the phone or by email. They can be contacted 24 hours a day, at any day of the week.

Source: Complete Realty Team Offers Tips for Buying a Home in 2023

Top Reasons Homeowners Are Selling Their Homes

Are you on the fence about selling your home? If so, check out some of the reasons other homeowners are choosing to sell today despite trading in their lower mortgage rate for a higher one:

Some homeowners may not want to sell their homes because they don’t want to lose their historically low mortgage rate on their current home. You might feel the same way if you’re considering selling your house.

Even though mortgage rates are higher than they were a few years ago, there are other things to consider when moving that don’t involve money. In other words, your mortgage rate is important, but you may have other things going on in your life that make a move necessary, no matter where rates are today. As Jessica Lautz, Vice President of Demographics and Behavioral Insights at the National Association of Realtors (NAR), says:

Home sellers have historically moved when something in their lives changed – a new baby, a marriage, a divorce or a new job. . . .

If you’re thinking about selling your home, you might find it helpful to look into the other reasons people are moving today. Realtor.com’s Survey asked people who had recently sold their homes why they did so. In the graphic below, you can see how those homeowners reacted:

As the picture shows, the main reasons people sold their homes recently were a desire for something different or the fact that their current home no longer met their needs. Also noteworthy was whether or not they could work from home and if they needed a home office or were tied to a specific office location. They also wanted to be close to their family.

The results of the realtor.com survey are summed up as follows:

The primary reason homeowners decided to sell in the last year was the realization that, after so much time spent at home, they wanted different features and amenities, such as walkability, outdoor space, pool, etc. . . .

If, like the homeowners they talked to, you want features, space, or amenities that your current home can’t give you, it may be time to consider selling your home.

Even with the mortgage rates of today, your needs and wants may be enough to make you want to make a change. The best way to figure out what’s best for you is to work with a trusted real estate professional who can give you expert guidance and advice throughout the process. They can help you understand your choices so you can make a confident choice based on what’s most important to you and your family.

Summing It Up

Even though money is a big reason to or not to move, there is often a lot more to think about. Reasons that have nothing to do with money can also be very important. Let’s talk today if you need help figuring out the pros and cons of selling your house. If you have questions, please don’t hesitate to contact us at 404-410-6465 or visit CompleteRealtyTeam.com

Original post here: Top Reasons Homeowners Are Selling Their Homes

Friday, March 10, 2023

Realtor Ken Mandich Is Sharing Ways in Which Homeowners Can Use Their Equity

Realtor® Ken Mandich is sharing tips on how homeowners can use their equity in their property to achieve their life goals.

Real estate has been booming all across the United States since mid-2020 culminating in the highest national median home value in years in May 2022. The rising property values have resulted in homeowners realizing that the equity in the home they already own, either fully or partially, has significantly increased in value. In fact, on average, homeowners have gained over $30,000 in equity over the last year.

Ken Mandich talks about how American homeowners can make smart use of this windfall by saying, “Even if you are still making mortgage payments, your equity has undoubtedly increased since you moved in. Owning a larger stake in your property with debt repayment and the corresponding rise in property values after the pandemic are dually responsible for this increase in your net worth. In short, you have a real tangible asset that can be put to good use. There are several options available to you and the choice you make all depends on your personal and financial goals.”

There are three ways, according to Ken, that home equity can be leveraged - moving to a new house, reinvesting in the current property, or using the equity to fund a new venture. First, homeowners who feel their needs have outgrown their current home can use their equity as the downpayment on a larger home. On the other hand, property owners who want to downsize can move into a smaller home, with the leftover funds being available for any purpose they see fit.

Next, homeowners can also opt to renovate their current property to increase its value. Home improvement projects can be a cost-effective way to make affordable changes that give homeowners a large return on investment. For example, the National Association of Realtors reports that refinishing or replacing wood flooring makes the property more appealing in the eyes of buyers. An experienced Realtor®, such as Ken Mandich, can provide even more precise and updated guidance on the exact changes to a property that can net the highest returns.

Finally, home equity can be sold off and turned liquid for several purposes. Homeowners can fund business ventures, put the money towards their retirement, use it as tuition, or even use it to pay off pending debts that they might have. While the possibilities are left up to the homeowner's discretion, Ken Mandich warns against using the money for frivolous short-sighted spending.

"It is all up to you," Ken says, "It all comes down to what you envision for yourself - 5, 10, 20 years from now. When you have made that decision or need help in figuring out what choice is right for you, give me a call. We can go over your current equity, map out the options available to you, and make it happen."

Ken Mandich and Complete Realty Team are a part of ERA Sunrise Realty. His decade-long experience buying, renovating, investing, and flipping houses in Cobb County gives him an edge compared to other Realtors® in Georgia. The real estate services offered by Complete Realty Team include comparable home price analysis, open houses, property surveys, HOA agreements, credit reports, title companies, lenders, homeowners’ insurance, walkthroughs, terms of sale or purchase, concessions, repairs, and closing documents.

When asked about what drives him, Ken says, "My passion for helping people is why I chose to become a real estate agent. Real estate is one of the most accessible financial instruments that middle-income individuals and families have in the US for building wealth. So, watching my clients succeed with this wonderful opportunity is what motivates me to do what I do best."

https://www.youtube.com/watch?v=5ZNJjb2-Xp8

Ken Mandich and Complete Realty Team can be contacted at (404) 410-6465 or admin@completerealtyteam.com for inquiries. His services cover all of Cobb County including Acworth, Austell, Kennesaw, Mableton, Marietta, Powder Springs, Smyrna, and the entire Metro Atlanta area.

Source: Realtor Ken Mandich Is Sharing Ways in Which Homeowners Can Use Their Equity

What You Can Do Now To Get Ready To Buy A House

Are you ready to buy a home this year? Then watch this video to see how you can make homeownership a reality in 2023:

As rent prices continue to rise, many renters want to know what they can do to get ready to buy their first home. Recent information from ApartmentList.com shows that:

The first half of 2021 has seen the fastest growth in rent prices since the start of our estimates in 2017. Our national rent index has increased by 11.4 percent since January . . .

If you rent, the rising cost may make saving up for a home seem impossible. But the truth is that you can and should do things to get ready to buy your first home. Here’s what to do if you want to learn more about getting out from rising rents.

Even small amounts should be saved. Now, experts agree that putting away what you can, even if it’s just a tiny amount, into a savings account is a great way to start saving for a down payment. The founder of Zero-Based Budget Coaching LLC, Cindy Zuniga-Sanchez, says:

I recommend saving for a home in a ‘sinking fund’ . . . . This is a savings account separate from your emergency fund that you use to save for a short or mid-term expense.

Work On Your Credit And Assess Your Finances

Experts also say that you should look at your overall finances and credit score and find ways to pay down your debt. The average credit score of first-time homebuyers is 716, according to the HUD. Many online tools can help you determine your credit score if you don’t know it. Don’t worry if your score is less than that. Remember that an average means that there are homeowners with credit scores both above and below that threshold.

If you find out that your credit score is below average, you can improve it in a number of ways before you apply for a loan. HUD says that you should get as much of your debt paid off as you can, pay your bills on time, and use your credit card wisely.

Now Is The Time To Start The Conversation With A Real Estate Professional

Last but not least, it’s important to talk to someone who knows the market and what it takes to buy a house for the first time. We can help with that. A trusted advisor can help you find your way around your market and explain all of your options. Having the right network of real estate and lending professionals on your side can help you plan for the home-buying process and figure out what you can afford and how to get pre-approved when you’re ready.

Most importantly, we can help you see how you can own your own home. As Accredited Financial Advisor Lauren Bringle from Self Financial says:

Don’t write home ownership off just because you have a low income . . . . With the right tools, resources and assistance, you could still achieve your dream.

Summing It Up

If you want to own your own home someday, the best thing you can do is start getting ready now. Even if you don’t think you’ll buy for a few years, let’s talk today to talk about the process and help make you ready to be a homeowner. You can reach us at 404-410-6465 or visit CompleteRealtyTeam.com

Original post here: What You Can Do Now To Get Ready To Buy A House

Tuesday, March 7, 2023

Georgia Complete Realty Team Believes Sellers Might Have an Edge This Spring

Cobb County Realtor® Ken Mandich is offering real estate advice to homeowners aiming to sell their property in the first half of 2023.

Low housing inventory has propelled home prices to new heights over the last couple of years with the national median home price hitting its peak in May 2022. Prices have since fallen from those levels but they are still substantially higher than they were in the first quarter of 2020. While the number of homes on the market is greater than in 2022, they are still much lower than the abundant inventory that was available to buyers in 2020.

Ken Mandich interprets the state of the real estate market for homeowners in Georgia by saying, “If you want to move, this is a good time to sell your house or buy a new one. There are more homes to buy right now than at any time in the last two years and you are more likely to find a property that suits your needs, within your budget. If you are selling, you still have an edge in the market. You just have to be smart about pricing your property. With a shortage of listings as compared to 2020, if your house is priced right, it will sell pretty quickly and you’ll be on your way to greener pastures in no time.”

Ken’s analysis is supported by the latest statistics published by Realtor.com. The latest Monthly Housing Market Trends report revealed that January 2023 had 248,000 (65.5%) more homes for sale nationwide than a year before. At the same time, it is still 43.2% lower than the number of homes that were on the market between 2017 and 2019. Homebuyers are also motivated by low mortgage rates which are lower now than they were last fall.

“If you are planning on selling your house in the upcoming months, there is no better time than now to pull the trigger,” Ken Mandich says, “You’ll get a ton of buyers interested in your current property and a killer deal on your new mortgage. Capitalize on this opportunity to kickstart the next phase of your life. If you need any help or advice with your property in Cobb County, give me a call. I and my team of real estate experts will guide you every step of the way - from the initial listing to a successful closing.”

Ken Mandich specializes in Cobb County real estate including properties in Acworth, Austell, Kennesaw, Mableton, Marietta, Powder Springs, Smyrna, and the entire Metro Atlanta area. He can help Georgia homeowners with every aspect of real estate including performing a comparable home price analysis, organizing open houses, conducting property surveys, drafting HOA agreements, pulling credit reports, title companies, lenders, homeowners’ insurance, walkthroughs, creating terms of sale or purchase, concessions, repairs, and closing documents.

Ken Mandich has over 10 years of experience investing in real estate and flipping houses in the North Metro area. Now, as a part of ERA Sunrise Realty, Ken is helping Georgians reach their real estate goals through the combination of technology and his real-world expertise. Whether a client is downsizing, relocating, selling, buying, or investing in property, Ken Mandich and Complete Realty Team have perfected the real estate experience to make it as stress-free as possible.

Ken talks about what separates him from other Realtors® in Cobb County by saying, “Not only do we have the best and latest market information but, due to my familiarity of Cobb County real estate, I can also offer you insights that no one else can. The result is a greater return on your real estate investment for you and your family. I also believe that effective client communication is just as important as my real estate expertise. When working with me, you will be always kept fully updated on the status of your transaction. If you have any questions, I’ll only be a phone call away.”

https://www.youtube.com/watch?v=TyzBHVbmYqs

Readers can get in touch with Ken Mandich and Complete Realty Team at (404) 410-6465 or admin@completerealtyteam.com.

Source: Georgia Complete Realty Team Believes Sellers Might Have an Edge This Spring

There Is No Reason To Fear A Wave Of Foreclosures In 2023

If you are concerned about the latest news of foreclosures rising in the U.S. it’s important to put it into the correct context. Check out this video to learn more:

You’re not the only one if you’ve read recent news regarding the rise in foreclosures in the housing market. The tales in the media can, without question, be somewhat perplexing at the moment. They might even cause you to reconsider buying a house out of concern that the market might crash. Many people want to know the truth about what is happening right now. In that case, it is imperative to comprehend what the data actually means when it indicates that a foreclosure catastrophe is not where the market is headed. Let’s take a closer look.

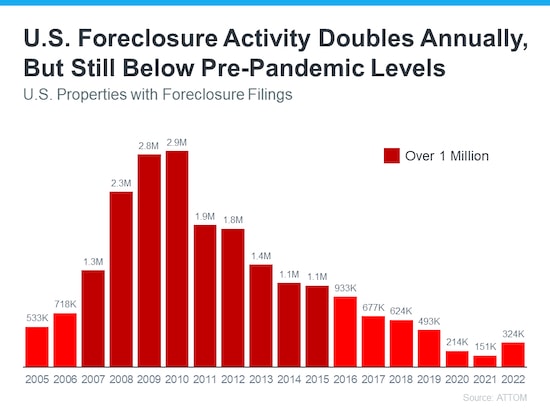

Foreclosure filings are up 115% from 2021 but down 34% from 2019, according to ATTOM’s Year-End 2022 U.S. Foreclosure Market Report. Putting this 115% surge in context is more crucial than ever as media headlines focus solely on this number.

Although the number of foreclosure files more than doubled last year, it’s essential to keep in mind why this occurred and how it relates to the market’s more typical pre-pandemic years. Foreclosure filings were at record-low levels in 2020 and 2021 as a result of the forbearance program and other homeowner relief alternatives, so any increase last year is — unsurprisingly — a surge up. According to ATTOM’s Executive VP of Market Intelligence, Rick Sharga:

Eighteen months after the end of the government’s foreclosure moratorium, and with less than five percent of the 8.4 million borrowers who entered the CARES Act forbearance program remaining, foreclosure activity remains significantly lower than it was prior to the COVID-19 pandemic. It seems clear that government and mortgage industry efforts during the pandemic, coupled with a strong economy, have helped prevent millions of unnecessary foreclosures.

These choices undoubtedly allowed millions of homeowners to remain in their properties, enabling them to rebuild their lives at a very trying time. Due to rising property values at the same time, many homeowners who might otherwise have faced foreclosure were able to use their equity and sell their homes instead, and this pattern is still present today.

Furthermore, keep in mind that today’s foreclosure rates are significantly lower than the record-breaking 2.9 million that were recorded in 2010 during the housing market meltdown, as shown in the graph below.

Even though the number of foreclosures is increasing, perspective is essential. Founder and Author of Calculated Risk Bill McBride recently noted:

The bottom line is there will be an increase in foreclosures over the next year (from record low levels), but there will not be a huge wave of distressed sales as happened following the housing bubble. The distressed sales during the housing bust led to cascading price declines, and that will not happen this time.

Summing It Up

Contextualizing the data is more crucial than ever right now. Although there is a projected increase in foreclosures in the housing market, they are still well below the crisis levels experienced when the housing bubble burst so that home prices won’t fall.

If you have questions about the housing market, don’t hesitate to get in touch. You can reach us at 404-410-6465 or visit CompleteRealtyTeam.com.

Original post here: There Is No Reason To Fear A Wave Of Foreclosures In 2023

Friday, March 3, 2023

Ways Homeowners Can Use Their Equity

Wondering about what you can do with the equity in your home? Then check out this video:

If you own a home, chances are your equity has grown dramatically in recent years as property values have risen and you have paid your monthly mortgage payments. Home equity accumulates over time and might assist you in achieving specific goals. According to CoreLogic’s newest Equity Insights Report, the average home loan borrower currently has about $300,000 in equity.

When you consider your options, it’s critical to understand your assets and how you may leverage them, especially in light of inflation and speculation of a recession. A real estate specialist is the best resource for determining how much home equity you have and advising you on how to spend it. Here are a couple of such instances.

Buy a House That Suits Your Lifestyle

If you no longer have enough space, it may be time to relocate to a larger house. You may also have too much space and require something smaller. In any case, consider leveraging your equity to fund a move into a home that better suits your changing lifestyle.

If you wish to improve your property, you can use your equity to put down on the home of your dreams. If you want to downsize, you may be shocked to learn that your equity may cover part, if not all, of the cost of your next house. A real estate advisor can help you determine how much equity you have and how you might use it to buy your next house.

Reinvest in Your Existing Home

According to a recent Point poll, 39% of homeowners would engage in home repair projects if they could tap into their equity. This is a wonderful alternative if you want to make some changes to your living space but aren’t ready to move yet.

Home improvement projects allow you to tailor your home to your specific needs and preferences. Just keep in mind that some home improvements add more value to your home and are more likely to appeal to future buyers than others. According to a National Association of Realtors (NAR) survey, repairing or replacing wood flooring has a high cost recovery. Consult a local specialist for the best advice on the projects to invest in to maximize your return when you sell.

Pursue Your Personal Dreams

Home equity can help you reach your life goals in addition to helping you relocate or update your property. This could be investing in a new business, retiring or downsizing, or supporting a college degree. While you shouldn’t utilize your equity for wasteful spending, leveraging it to establish a business or putting it toward college expenses can help you attain other lifelong goals.

In Conclusion

Your equity has the potential to change the game. Let’s connect if you’re wondering how much equity you have in your property so you can start planning your next move. If you want to know how much equity you have in your home, or just have questions, give us a call at 404-410-6465 or visit CompleteRealtyTeam.com.

Original post here: Ways Homeowners Can Use Their Equity

Tuesday, February 28, 2023

Sellers Could Be In A Sweet Spot This Spring

Are you considering selling your house this spring? If so, you might be in a real sweet spot – learn more in this video:

The number of homes for sale is up from last year but still lower than in pre-pandemic years.

The most significant difficulty in the housing market right now, and certainly for the foreseeable future, is the scarcity of available homes in comparison to the amount of people looking to buy. That is why, if you are considering selling your home, now is a perfect time to do so. Your home would be welcomed in a market with fewer available homes than in the years preceding the pandemic.

According to Realtor.com’s most recent Monthly Home Market Trends Report:

“There were 65.5% more homes for sale in January compared to the same time in 2022. This means that there were 248,000 more homes available to buy this past month compared to one year ago. While the number of homes for sale is increasing, it is still 43.2% lower than it was before the pandemic in 2017 to 2019. This means that there are still fewer homes available to buy on a typical day than there were a few years ago.”

How Does This Affect You?

With fewer properties for sale, purchasers have fewer options than before the pandemic, and this aggravation is prompting some to abandon the homebuying process entirely. But, with mortgage rates lower than they were last fall, more buyers are eager to re-enter the market—they simply need to locate properties to buy. This is encouraging activity for the spring market, especially if you’re considering selling your home.

The New York Times (NYT) reported on many people’s newfound interest in purchasing a home:

“Home buyers are edging back into the market after being sidelined last year . . .”

To meet the demand of today’s home buyers, the housing industry needs more homes for sale. If you’ve considered selling, now is the time to connect and get ready to make a move this spring. This spring could be your chance if you want to take advantage of the current market conditions.

If you’re ready to sell or just have questions, reach out to us at 404-410-6465 or visit CompleteRealtyTeam.com. Thanks and until next time!

Original post here: Sellers Could Be In A Sweet Spot This Spring

Friday, February 24, 2023

Why You Need To Be Pre-Approved When Shopping For A Home

Are you ready to buy a new home? Then be sure and watch this video to find out the difference between pre-qualified and pre-approved, as well as why you should get pre-approved first:

Being pre-approved is one of the initial steps in the home-buying process. To understand why pre-approval is such a vital step, you must first grasp what it is and what it accomplishes for you. According to Business Insider:

In a preapproval [sic], the lender tells you which types of loans you may be eligible to take out, how much you may be approved to borrow, and what your rate could be.

Pre-approval essentially provides you with vital information about the home-buying process that will assist you in understanding your options and how much you may be able to borrow.

How does it work? A lender will examine your finances as part of the pre-approval process to decide how much money they are willing to lend you. Your lender will then provide you with a pre-approval letter to help you understand how much money you can borrow. This can make it easy when you go house hunting because you’ll know your total stats. Moreover, with increasing mortgage rates affecting affordability for many buyers today, knowing your figures is even more crucial.

Pre-Approval Shows Sellers You Are A Serious Buyer

Another advantage is that pre-approval might make a seller more confident in your offer because it shows you’re serious about purchasing their home. According to a recent Forbes article:

From the seller’s perspective, a preapproval [sic] letter from a reputable local lender often can make the difference between accepting and rejecting an offer.

This demonstrates that, while you may not encounter the tremendous bidding wars seen during the pandemic, pre-approval is still a crucial aspect of creating a solid offer. According to Christy Bieber, Personal Financial Editor at The Motley Fool, says it may be the most crucial component of making an offer:

Pre-approval maximizes the chances you’ll be able to actually close the deal – and sellers want to see that.

The fact that a pre-approval gives you a better chance of getting your offer accepted is undoubtedly the most important reason to complete this step . . .

Summing It Up

Being pre-approved is a critical first step in the home-buying process. It informs you of your borrowing capacity and demonstrates to sellers that you are serious about purchasing their home. If you are in the market for a new home and need to connect with a reputable lender, get in touch, we’ll be more than happy to connect you with our favorite mortgage brokers. You can reach us at 404-410-6465 or visit CompleteRealtyTeam.com. Thanks – and until next time!

Original post here: Why You Need To Be Pre-Approved When Shopping For A Home

Wednesday, February 22, 2023

Complete Realty Team Posts Blog and YT Video About the Do's and Don'ts When Trying to Buy a Home

Marietta, Georgia-based Complete Realty Team strives to be one of the most well-rounded real estate services providers in the Greater Atlanta area. This effort has led them to be one of the top choices among the communities it serves when it comes to home selling and buying. But what this reputable realty team does goes well beyond just those two acts. It also tries to keep those in Marietta and the surrounding areas better informed on current Georgia real estate trends and happenings. As an example, this company has just released a YouTube video and blog post that discuss the do's and don'ts when trying to buy a home. Team Leader, Ken Mandich, says, “We here at the Complete Realty Team like to use our keen insight in the Atlanta area real estate scene to help home buyers and sellers simplify that process as much as possible. This includes providing pertinent information that’s related to obtaining mortgages. That’s why we recently produced and posted a new YouTube video and blog article that contained suggestions on what to avoid after a mortgage has been applied for.”

Mandich stated that at best, obtaining mortgages involves a tricky process that is subject to both a bank associate’s judgment and strict financial formulas. That’s why it’s so important for prospective home buyers to avoid some common pitfalls that can hinder their chance of getting a mortgage. In the introduction to this new YouTube video by the Complete Realty Team, Mandich says, “Have you recently applied for a mortgage? If so, follow these simple tips. Tips that if they are not followed increase the chances of a mortgage application being rejected. The first tip in the recently posted video was to not deposit a large sum of money in the bank after a new mortgage has been applied for. Something that sometimes will create a red flag situation. It was also suggested in this YouTube video not to cosign any loans while the application is pending or not to make any large purchases because both of these will increase a person’s debt-to-income ratio. Switching bank accounts during this time is also considered a no-no to remaining financially consistent and it was also stated in the video not to apply for new credit or close any bank accounts because these occurrences can hurt credit scores. It was also suggested in this Complete Realty Team video for a person to touch base with their lender before making any big financial decisions. The video ended with Mandich stating, “If you’re in the process of buying a home, lean on the pros for expert advice and guidance along the way. I’m Ken Mandich and if you have questions about your next move - get in touch. Until next time!”

The accompanying blog article expanded on the things to avoid when purchasing a house as far as mortgages are concerned. It starts by mentioning that while it’s exciting for a home buyer to start thinking about moving in and decorating after they’ve applied for your mortgage, there are some key things to keep in mind before the deal closes. As was stated in the recently released YouTube video, this article again emphasizes not depositing large sums of cash, making any large purchases, cosigning a loan, or switching or closing bank accounts. Occurrences that are all known to lead to mortgage application denial as they impact such key loan acceptance factors as debt-to-income ratios and financial inconsistency. This blog also once again emphasized discussing the financial actions mentioned above with the mortgage lender before making them. The article ended with Mandich reminding that he and the others on his experienced and competent team can help prospective home buyers with guidance during the mortgage application process.

https://www.youtube.com/watch?v=FdhfUuxePtE

The team leader also wanted to talk about some other traits that make them a great choice for selling or buying a house in Cobb County. Something that starts with their unique ability to combine cutting-edge real estate technology with a more human approach to doing business. It’s also a real estate team that takes pride in immersing itself in every aspect of real estate transactions such as comparable home price analysis, open houses, property surveys, HOA agreements, credit reports, titles, lending, and closing documents. More information on the real estate services that the Complete Realty Team offers can be had by referring to the company website.

Source: Complete Realty Team Posts Blog and YT Video About the Do's and Don'ts When Trying to Buy a Home

Tuesday, February 21, 2023

Don’t Put Off Buying A Home Waiting On 3 Percent Rates

Are you thinking you should wait for rates to drop to 4% or maybe even 3%? Then Watch this:

The Federal Reserve took action to try and lower inflation last year. Mortgage rates quickly increased in response to such initiatives from the all-time lows we experienced in 2021, reaching a peak of just over 7% last October. As a result, prospective buyers’ purchasing power was reduced, which led to some of them pausing their plans.

The rate of inflation is now beginning to decline. Mortgage rates have fallen below their peak from last year as a result. Sam Khater, Freddie Mac’s chief economist, explains:

While mortgage market activity has significantly shrunk over the last year, inflationary pressures are easing and should lead to lower mortgage rates in 2023.

If you’re a buyer looking to enter the home market again, that could be fantastic news for you. Any decrease in mortgage rates increases your ability to buy by lowering your anticipated monthly mortgage payment. The reduced mortgage rates that analysts anticipate this year may be exactly what you need to rekindle your desire to buy a home.

While this presents a chance for you, keep in mind that rates won’t likely return to the historic lows we witnessed in 2021. Analysts concur that this is not the range on which purchasers should bet. Bankrate’s Chief Financial Analyst, Greg McBride, explains:

I think we could be surprised at how much mortgage rates pull back this year. But we’re not going back to 3 percent anytime soon, because inflation is not going back to 2 percent anytime soon.

In order to have a realistic outlook for this year, it’s vital to seek the assistance of knowledgeable real estate professionals. You might be shocked by the effect of even a slight mortgage rate decrease on your spending plan. If you’re prepared to purchase a home right away, the current market offers the chance to find your ideal home, obtain a cheaper mortgage rate, and have less buyer competition.

Summing It Up

The recent decrease in mortgage rates is fantastic news, but waiting until 3% if you’re ready to buy now is a mistake. Please consult a local lender to determine how current interest rates may affect your objectives, and then get in touch to discuss your possibilities in the local Cobb County real estate market. You can reach us at 404-410-6465, or visit CompleteRealtyTeam.com.

Original post here: Don’t Put Off Buying A Home Waiting On 3 Percent Rates

Friday, February 17, 2023

Avoid Derailing Your Home Loan By Following These Tips

If you have just applied for a home loan, check out this video about what not to do so it doesn't get denied:

Although it's terrific to begin planning your move and decorating once you've filed for a home loan, there are some important considerations to make before closing. Following your loan application, there are a few things you should avoid.

Avoid Making Large Cash Deposits

Cash is hard to track down, and lenders need to know where you got your money. Talk with your loan officer about properly recording your transactions before depositing any large amounts of money into your accounts.

Avoid Making Any Major Purchases

You could lose your loan if you make purchases that are out of the ordinary. Lenders may raise concerns about any sizable purchases. Debt-to-income ratios are higher for those with new debt (how much debt you have compared to your monthly income). With higher debt ratios, you'll be a riskier loan, and may no longer be eligible for a home loan. Avoid the urge to make any significant purchases, including those for appliances or furnishings.

Don't Cosign for Anyone's Loans

You assume responsibility for the loan's success and repayment when you cosign for it. Higher debt-to-income ratios result from that obligation. Your lender will have to count the payments against you even if you state that you won't be the one making them.

Avoid Changing Bank Accounts

Lenders must locate and track of your assets, including your bank accounts. When all of your accounts are consistent, that work is significantly more straightforward. Speak with your loan officer prior to making any financial transfers.

Avoid Getting Any New Credit Or Cards

Having your credit report checked by businesses in numerous financial channels (mortgage, credit card, auto, etc.) will affect your FICO® score, regardless of whether you're applying for a new credit card or a new car. Poor credit scores can affect your interest rate and perhaps even your approval eligibility.

Don't Close Any Old Accounts

Many purchasers think they are less risky and more likely to get approved if they have less accessible credit. That is untrue. Your total credit usage as a percentage of available credit and the length and depth of your credit history (as opposed to merely your payment history) play a significant role in determining your credit score. Both of those parts of your score are lowered by closing any inactive accounts.

DO Communicate With Your Lender About Any Changes

When speaking with your lender, be totally honest about any changes that take place or that you anticipate taking place. Any changes to your income, assets, or credit should be carefully considered and handled so that your home loan will still be granted. Inform your lender as well if your employment situation has changed recently. In the end, it's always preferable to be completely honest and open with your loan officer before making any financial decisions.

Summing It Up

You want everything to go as smoothly as possible when you buy a house. Remember to speak with your lender—someone qualified to explain how your financial actions may affect your home loan—before you make any significant purchases, money transfers, or other life changes.

If you are in the market for a new home, selling one that you have, or just have questions, reach out. You can contact us at 404-410-6465 or visit CompleteRealtyTeam.com.

The preceding Article Avoid Derailing Your Home Loan By Following These Tips was first seen on Complete Realty Team. See more on: Complete Realty Team - Ken Mandich - REALTOR - ERA Sunrise Realty Blog

Thursday, February 16, 2023

Marietta Complete Realty Team Posts a Video and Article that Discuss What Home Sellers Need to Know About Selling Now

Marietta’s Complete Realty Team has dedicated itself to helping home buyers and sellers in its Georgia area help smooth out those processes. It’s an experienced real estate team that likes to pass on its keen insight into the Cobb County real estate market to those looking to make home acquisitions or sell homes in that county, Metro Atlanta, and other surrounding areas. A good example of that comes in the forms of a recent Video and Blog Article that this real estate agency created. Media forms that discuss what sellers need to know about selling in today’s current real estate market.

Ken Mandich, the team leader at Complete Realty Team, says, "We are always looking for better ways to inform our clients and others as to the current real estate market in Marietta and the surrounding areas. Our new video and blog article are good examples of that. We will continue to do whatever it takes to make sure home buyers and sellers in Cobb County and Metro Atlanta stay as informed as possible to current real estate trends in the area.”

This newly posted Complete Realty Team video is directed at those interested in ‘selling your house' in Marietta and the surrounding Cobb County area’s starts by stating that the company realizes that many people are hesitant to sell their homes now because they’ve heard that the real estate market has cooled over the past year. The company states in the video script that this is not entirely true and that good selling opportunities still exist. That is if a seller is willing to do certain things on their end. This includes being slightly flexible when it comes to negotiations. That’s because as more sale homes come into the marketplace buyers have more options to choose from. Second, their home’s sale price must be priced fairly. Something that knowledgeable real estate teams such as theirs with all of the tools they have at their disposal can definitely help with. Lastly, the video states that home sellers must do everything within their means to make a great first impression on prospective buyers. The video ended by saying that those at the Complete Realty Team are always willing to discuss these things further with those that are considering outing their Atlanta and Cobb County homes up for sale.

The recently posted blog article is titled ‘Want to Sell Your House? Price It Right’. It expands upon the second point that was mentioned above in the newly released video. This article talks about why it’s important for home sellers to somewhat adjust their expectations in response to the housing market slowdown that resulted from a hike in mortgage rates. Key points in the article include what happens if a home is priced too low or too high and why it’s best to price a home right from the start. The blog stated that this is another area where the seasoned real estate professionals at Complete Realty Team are more than qualified to help.

Ken Mandich, the team leader at Complete Realty Team, described their philosophy by saying, “We believe the home selling and buying process should be fun and be as stress-free as possible. Our team accomplishes this by placing knowledgeable and caring real estate experts by your side. People that are ready and able to help you understand the process and look out for your best interests. Not to mention we will display a human touch the entire time we are helping you.”

https://www.youtube.com/watch?v=BwKWyRQsOCE

Mandich also talked about how they use cutting-edge technology, take advantage of digital marketing, and take the most honest approach when it comes to giving their clients peace of mind as they search for or look to sell a home. Something that’s ultra-important in today’s very different housing market. He also brings a unique perspective to real estate buying and selling because of his many years of experience renovating and ‘flipping’ homes. Firsthand knowledge that few real estate team leaders possess. Mandich added that those that are interested in using creative ways to ‘selling your house in Cobb County or Metro Atlanta can contact them by phone, email, or by using the form that’s found on the Complete Realty Team website.

Source: Marietta Complete Realty Team Posts a Video and Article that Discuss What Home Sellers Need to Know About Selling Now

Tuesday, February 14, 2023

Interested In Selling Your Home? Price It Right

Due to increasing mortgage rates, the housing market slowed down last year, which had an effect on property values. If you're considering selling your house soon, you should modify your expectations in line with that. As explained on realtor.com:

“. . . some of the more prominent pandemic trends have changed, so sellers might wish to adjust accordingly to get the best deal possible.”

In a more balanced market, how you price your home will significantly impact your bottom line and the potential speed of sale. And the truth is that in today's market, houses that are priced fairly continue to sell.

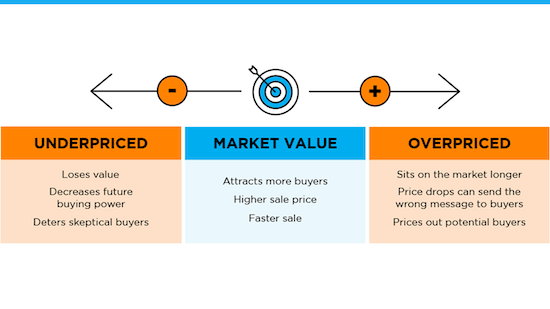

Why a Fair, Appropriate Price for Your Home Is Important

Your asking price conveys a message to potential buyers, especially in today's market.

If it's priced too low, you risk losing money or discouraging purchasers who could see a lower-than-expected price tag and question if the house has a problem.

Price it too high, and you run the risk of scaring away potential customers. When that occurs, you might need to reduce the asking price in an effort to rekindle interest in your home after it has been sitting on the market for some time. Be mindful, as some purchasers may interpret a price reduction as a warning sign concerning the property.

Price it accurately from the beginning to avoid either headache. An expert in real estate knows how to choose the right asking price. To determine the right price, they weigh factors like the value of nearby properties, current market trends, buyer demand, the state of your home, and more. This increases the chances that you will receive stronger bids and that your home will sell more quickly.

The illustration below summarizes the potential effects of your asking price:

Learn more about selling your house and what you need to do in today's changing real estate market in this video:

Summing It Up:

Homes with current market value pricing are still selling. Let's connect to ensure that you accurately price your home, maximize your sales potential, and reduce your hassle. You can contact us, even for just questions at CompleteRealtyTeam.com, or give us a call at 404-410-6465

The preceding Post Interested In Selling Your Home? Price It Right was first published to CompleteRealtyTeam.com. Find more at: Complete Realty Team Buyer’s Agent Blog

Georgia Fights Property Tax Surge: Capping vs. Exempting

Home values in Georgia have surged, leading property taxes to ↑ 41% since 2018. Lawmakers are proposing solutions: 1. Senate: – Cap an...

-

Buying a home can be intimidating, especially in a hot housing market. Before starting to shop for a home, it's important to know how m...

-

Home values in Georgia have surged, leading property taxes to ↑ 41% since 2018. Lawmakers are proposing solutions: 1. Senate: – Cap an...

-

Building a home in Georgia averages $136/sq ft, ranging $100K-$400K+, depending on factors. DIY home building is feasible in Georgia, in...