Georgia's housing market is hot, with Atlanta and Gainesville being two of the hottest metro areas in the country.

Original post here: Georgia’s Market: High Demand, Low Supply

Georgia's housing market is hot, with Atlanta and Gainesville being two of the hottest metro areas in the country.

Conventional loans are a popular type of loan for home buyers, offered by private lenders and requiring a down payment of 3-5% and decent credit. These loans come in two main varieties – conforming loans with a maximum loan amount set by the government, and non-conforming loans with no limit. Borrowers should consider their individual situations to determine which type of loan is right for them.

25% of homeowners plan to buy new homes in the next two to five years.

Homeowners may wait a min of two years to avoid capital gains tax.

They also may rely on the equity in their current home for their next purchase.

Experts predicts ↓ 35% drop in office values by 2025 due to rising interest rates and reduced demand.

Structural shifts in remote work and reduced physical occupancy contribute to the decline in office space demand.

Vacancy rates have increased, leading to negative rental growth and falling net operating incomes.

The August Rental Activity Reports from RentCafe show a shift in renter preferences, with The Bronx rising three spots to #6, Queens jumping six spots to #13, and Manhattan climbing one spot to #37. This is due to decreases in listings and increases in page views, favorited apartments, and specific searches. These trends demonstrate changing housing dynamics and evolving urban landscapes.

If you’re a homeowner needing to move, you may have considered using your current home as a short-term rental or Air BnB property rather than selling it. A short-term rental (STR) is often offered as an alternative to a hotel, and it’s become a popular investment in recent years.

While a short-term rental may seem appealing, the reality of being responsible for one may be tough to accept. Here are some of the issues you may face if you rent out your home rather than selling it.

It takes a lot of time and work to successfully manage your residence as a short-term rental. You’ll have to deal with reservations, organize check-ins, and handle cleaning, landscaping, and maintenance jobs. Each of these can be taxing on its own, but when combined, it’s a lot to handle.

Because new guests check in and out regularly, short-term rentals have a high turnover rate. Because of the increased wear and tear on your property, you may need to make more regular repairs or replace your furnishings, fixtures, and appliances more frequently.

Consider your ability to commit, particularly if you intend to use a platform to publicize your rental property. The majority of them have certain standards that hosts must meet. According to a Bankrate article:

Managing a rental property can be time-consuming and challenging. Are you handy and able to make some repairs yourself? If not, do you have a network of affordable contractors you can reach out to in a pinch? Consider whether you want to take on the added responsibility of being a landlord, which means screening tenants and fielding issues, among other responsibilities, or paying for a third party to take care of things instead.

There are numerous factors to consider before converting your home into a short-term rental. If you are not prepared to put in the effort, it may be better to sell.

As the short-term rental sector expands, so do the restrictions. Limits on the number of holiday rentals in a specific place are regular legal restrictions. This is especially true in major cities and tourist areas where there may be concerns about overpopulation or a lack of permanent housing. There may also be restrictions on the type of property that can be utilized for short-term rentals.

Before renting out their properties, many cities require landowners to obtain a license or permit. Deckard Technologies’ CEO, Nick Del Pego, explains:

Renting short-term rentals is considered a business by most local governments, and owners must comply with specific workplace regulations and business licensing rules established in their local communities.

Before considering renting out your house, you should extensively investigate if short-term rentals are regulated or restricted by the local government and your homeowners’ association (HOA).

Converting your house into a short-term rental is not a decision you should make lightly. Get in touch with us if you have questions about whether or not you should sell or rent out your house at (404) 410-6465 or visit Complete Realty Team.

Wisconsin leads in property investment interest, with 459.4 monthly searches / 100K people.

The state of Georgia has launched a program called Georgia Mortgage Assistance which allows eligible residents to receive grants up to $50,000 to help pay off their mortgage. The program is funded by the American Rescue Plan Act of 2021 and applications are now open. There are three different ways the program can assist recipients, including mortgage reinstatement, reducing the total mortgage loan balance, and making payments to vendors to reduce housing expenses. Eligibility requirements include being a resident of Georgia, meeting certain Area Median Income limits, and other conditions.

For first-time homebuyers, understanding and navigating the pre-approval process can be a daunting task. However, with the right knowledge and preparation, it can be a smooth and efficient process. The top 10 tips for first-time homebuyers include understanding the importance of pre-approval, checking your credit score, determining a budget, gathering necessary documentation, researching lenders, getting multiple quotes, being prepared for a hard credit inquiry, being honest about your financial situation, and not overextending.

Smart home products and systems are increasingly influential in attracting buyers across different price points.

>34% of likely buyers would pay a few thousand dollars extra for a smart home compared to a non-smart home.

~85% of buyers consider smart home features important, with ~40% expecting to pay no additional cost.

Homeowners who are looking for ways to access cash in their home without having to refinance to a higher rate than what they currently have can explore their home equity options. These include home equity loans, which come with lower interest rates than other credit types and a tax deduction on the interest paid, and HELOCs, which have variable interest rates and allow borrowers to deduct up to 80% of their home equity.

Clean up your credit:

– Check credit reports, dispute errors

Pay bills on time

Reduce debt, improve credit

Keep old cards

Avoid new accounts

Consider rapid rescore:

Update reports quickly

Request through lenders

Correct misinformation, pay debt

Results and potential fees

Consider rapid rescore:

Update reports quickly

Request through lenders

Correct misinformation, pay debt

Results and potential fees

Everyone is talking about home prices and the affordable housing crisis. A lot of people are wondering, or even think home prices are going to crash, mostly thanks to reporting from the media. But where are home prices headed for the end of 2023 and beyond? First, let’s look at where home prices are at the moment and how we got here.

The rate of increase in home values has been massive during the last two years. While this has resulted in enormous equity gains for homeowners, it has also led some home buyers to fear that home prices may decline. It’s critical to understand that the housing market isn’t a bubble ready to burst, and that home price increase is being sustained by solid market fundamentals.

Check out our video about home price forecasts from now till 2027:

To understand why price decreases are unlikely, it’s necessary to investigate what caused recent price increases and where analysts believe home prices are headed. Here’s what you should know.

Mostly thanks to the pandemic prices rose dramatically. Money was cheap, as in you could borrow money at very low rates, at 3% or lower. People suddenly had to switch from working at an office to working at home and these homeowners discovered they needed a home office. Some people either realized or couldn’t deal with the lack of space with the entire family being at home and needed more room just to have some breathing room or private time. As a result, people were buying houses left and right, bidding wars ensued and prices went through the roof. That puts us at where we are today with high home prices but with much higher mortgage rates.

If you’re thinking about purchasing a house, you’re probably paying attention to everything you hear about the housing market. You get your information from a variety of sources, including the news, social media, your real estate agent, talks with friends and family, overhearing someone talking at the grocery store, and so on. Most likely, home prices and mortgage rates will rise significantly.

Let’s take a look at the statistics to help you cut through the noise and get the information you need. As you make your selection, here are the top two questions you should ask yourself about home pricing and mortgage rates:

Pulsenomics’ Home Price Expectation study – a study of over one hundred economists, real estate specialists, investment and market strategists – is one reputable source of that information.

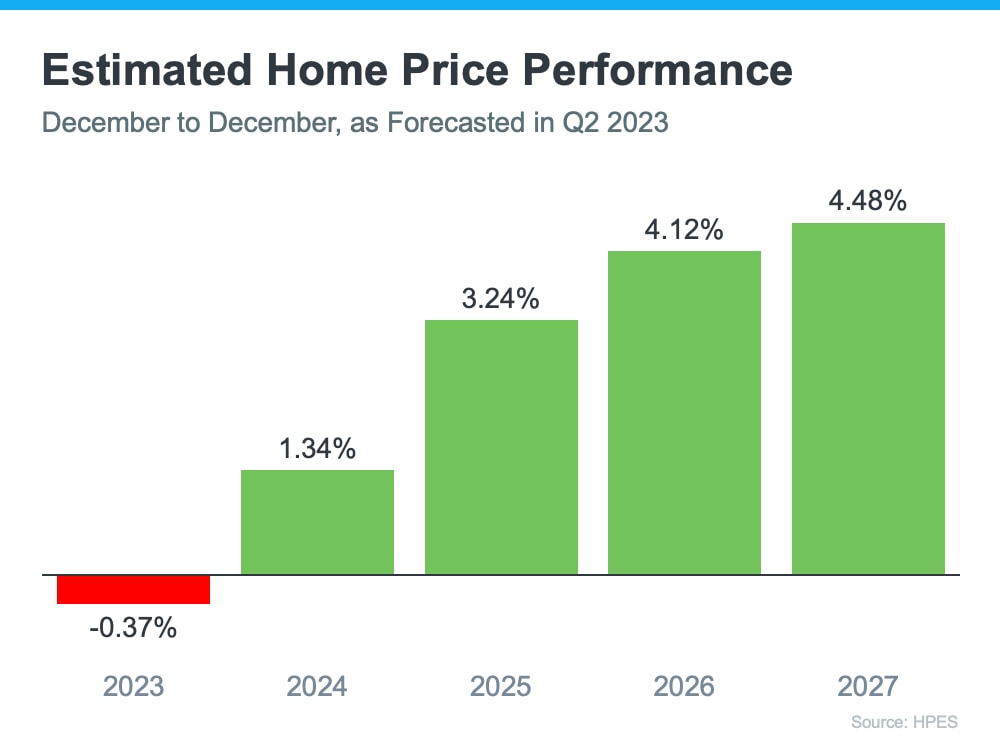

According to the most recent release, the experts polled predict a small depreciation this year (see red in the graph below). But here’s the most important context. The worst of the home price drops are now behind us, and prices are beginning to rise again in many cities. Not to mention, the 0.37% depreciation shown by HPES for 2023 is far from the crash that some predicted would occur.

Let’s turn our attention to the future. The green in the graph below indicates that prices have turned a corner and will rise in 2024 and beyond. The HPES predicts that after this year, home price appreciation will return to more average levels for the next several years.

So, why is this important to you? It means that your home’s worth will likely rise and you will build equity in the years ahead, but only if you buy now. Based on these projections, waiting will only cost you more money in the long run.

Mortgage rates have risen in response to economic uncertainty, inflation, and other factors over the last year. According to the most recent reports, inflation, while still high, has slowed since its peak. This is a positive indicator for the market and mortgage rates. This is why.

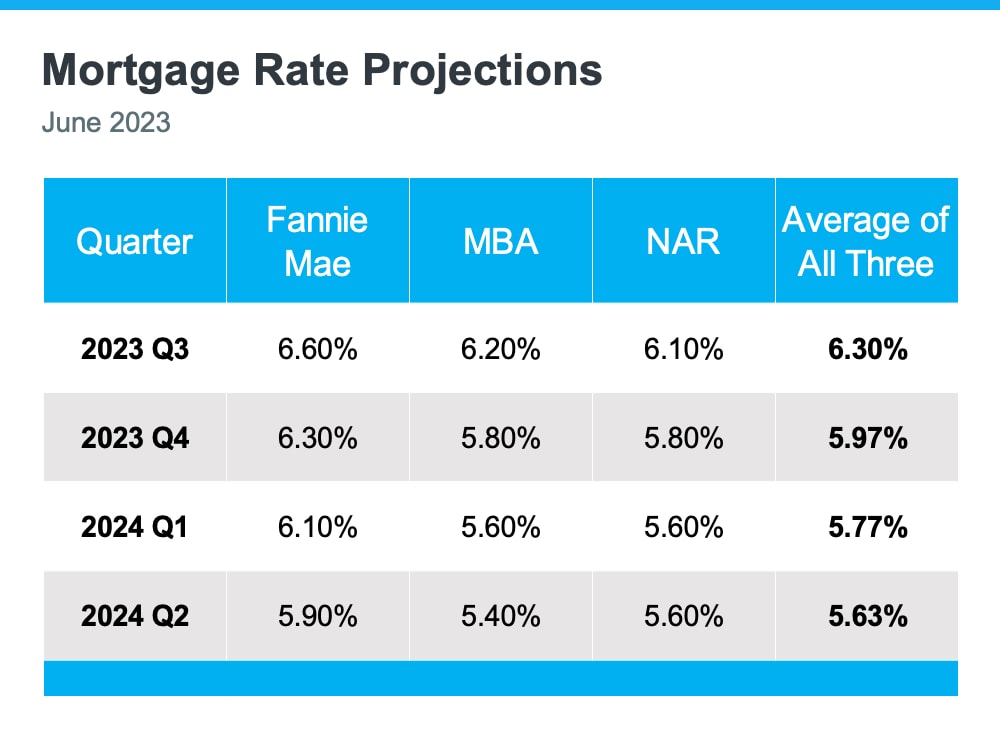

When inflation falls, mortgage rates tend to reduce as well. This could be why some analysts predict that mortgage rates will fall slightly over the following few quarters, settling somewhere between 5.5 and 6% on average, but that remains to be seen with rates now staying above 7% and may very well go to 8% or higher!

But no one, not even the experts, can predict where mortgage rates will be next year or even next month. This is because there are so many variables that might influence what happens. So, to give you a glimpse of the potential outcomes, consider the following:

If you’re considering buying a house, you should be aware of the current state of housing prices and mortgage rates. While no one can predict where they will go, real estate professionals can provide you with useful information to keep you informed. If you’re considering buying a home in Cobb County or the Metro Atlanta area and have questions just get in touch – (404) 410-6465 or visit Complete Realty Team to contact us by email.

Georgia home prices show significant upward trajectory, reflecting robust demand and limited inventory.

According to Bankrate and Freddie Mac, the current average interest rate for a 30-year-fixed mortgage is 7.58%, which is the highest it has been in over 20 years. Experts are now predicting that this could go up to 8%, if the economy continues to show signs of strength and the Federal Reserve raises interest rates again. If this happens, the housing market could go back into a deep freeze.

Home sales in Atlanta ↓14.9% MoM, amounting to 4,896 properties sold.

Sales volume measured at $2.37B, ↓ 17.4% MoM.

Lenders have guidelines regarding max DTI to approve a loan.

Many lendaers allow for DTI ratios up to 50%.

Still, loans with higher DTI ratios typically have worse terms.

Higher DTI may require a higher down payment to meet loan approval criteria.

U.S. mortgage rates are inching closer to 8%, a two-decade high, making homeownership increasingly out of reach for many Americans. The Federal Reserve's aggressive tightening campaign against inflation is causing upward pressure on market rates, making existing home sales slump further and potential first-time borrowers hesitant. Lawrence Yun, chief economist at the National Association of Realtors, believes mortgage rates could go higher than 8%, but also that the current high may be the peak before it retreats. In contrast, mortgage rates averaged 16.63% in the past. Perry Johnson, a Republican presidential candidate, filed a complaint with the

According to Bankrate and Freddie Mac, the current average interest rate for a 30-year-fixed mortgage is 7.58%, which is the highest it has been in over 20 years. Experts are now predicting that this could go up to 8%, if the economy continues to show signs of strength and the Federal Reserve raises interest rates again. If this happens, the housing market could go back into a deep freeze.

It turns out that sellers could win big with such low housing inventory.

Home sales in Atlanta ↓14.9% MoM, amounting to 4,896 properties sold.

Sales volume measured at $2.37B, ↓ 17.4% MoM.

Georgia home prices show significant upward trajectory, reflecting robust demand and limited inventory.

So you’ve undoubtedly seen some news concerning inflation and mortgage rates, as well as something about a Federal Reserve (the Fed) decision. You may be wondering what it all means for you, especially if you’re considering purchasing a home. Allow me to break it down for you.

The Fed is working really hard to reduce inflation. Even if the most recent figures show modest improvement, the inflation rate remains above the 2% target. One of the reasons the Fed chose to raise the Federal Rate again was because of this. According to Bankrate, the Fed has hiked interest rates for the tenth time in ten meetings to combat inflation and cool the economy, which has been growing since rebounding from the 2020 coronavirus recession.

The Fed’s activities do not directly affect mortgage rates, but they do have an impact. Their actions last year contributed to a purposeful downturn in the residential real estate market.

Everyday expenses, such as gas and groceries, are becoming more expensive as a result of high inflation. You’ve probably already observed this, especially at the Grocery store!! The Fed is attempting to reduce inflation by hiking the Federal Funds Rate. If they are successful, it may result in lower mortgage rates, making house ownership more accessible for you. This is because when inflation is high, so are mortgage rates. Experts predict that if inflation slows, mortgage rates will follow suit.

The problem is that Biden’s Administration has gone after America’s fossil fuel production. Here at Complete Realty Team we are all for having a cleaner planet, but it will take time to do so. We can’t stop our dependence on fossil fuels overnight. It takes energy to produce everything from the clothes on your back to the food on your table!

Inflation and mortgage rates will continue to have an impact on the housing market in the future. According to Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), mortgage rates will likely fall later this year as consumer price inflation moderates. Mortgage Bankers Association (MBA) Chief Economist Mike Fratantoni concurs, predicting that mortgage rates will fall this year as the economy slows.

Nobody knows what will happen to mortgage rates, but analysts believe they will fall this year if inflation falls as well. Connect with a reputable real estate advisor if you want to stay informed. They are aware of what is going on and can assist you in understanding what the experts are predicting and how it may affect your plans to purchase a home.

Don’t be perplexed by the recent Federal Reserve decision. What happens to mortgage rates is determined by the rate of inflation. Mortgage rates will fall if inflation cools off, but will go up if inflation continues.

Our take – rates are probably going to go up with the Fed already hinting at raising rates at least one more time this year. The last stat we saw is that inflation was at 3.2% with their target being 2%.

If you have questions, want to know your home’s value or to buy or sell a house, just visit Complete Realty Team or give us a call at (404) 410-6465. You can also go here to get more real estate news VIDEOS.

Home values in Georgia have surged, leading property taxes to ↑ 41% since 2018. Lawmakers are proposing solutions: 1. Senate: – Cap an...