Everyone is talking about home prices and the affordable housing crisis. A lot of people are wondering, or even think home prices are going to crash, mostly thanks to reporting from the media. But where are home prices headed for the end of 2023 and beyond? First, let’s look at where home prices are at the moment and how we got here.

The rate of increase in home values has been massive during the last two years. While this has resulted in enormous equity gains for homeowners, it has also led some home buyers to fear that home prices may decline. It’s critical to understand that the housing market isn’t a bubble ready to burst, and that home price increase is being sustained by solid market fundamentals.

Check out our video about home price forecasts from now till 2027:

To understand why price decreases are unlikely, it’s necessary to investigate what caused recent price increases and where analysts believe home prices are headed. Here’s what you should know.

Home Prices Rose Significantly in Recent Years

Mostly thanks to the pandemic prices rose dramatically. Money was cheap, as in you could borrow money at very low rates, at 3% or lower. People suddenly had to switch from working at an office to working at home and these homeowners discovered they needed a home office. Some people either realized or couldn’t deal with the lack of space with the entire family being at home and needed more room just to have some breathing room or private time. As a result, people were buying houses left and right, bidding wars ensued and prices went through the roof. That puts us at where we are today with high home prices but with much higher mortgage rates.

So What’s This Mean If You’re Considering Buying A Home?

If you’re thinking about purchasing a house, you’re probably paying attention to everything you hear about the housing market. You get your information from a variety of sources, including the news, social media, your real estate agent, talks with friends and family, overhearing someone talking at the grocery store, and so on. Most likely, home prices and mortgage rates will rise significantly.

Let’s take a look at the statistics to help you cut through the noise and get the information you need. As you make your selection, here are the top two questions you should ask yourself about home pricing and mortgage rates:

Where Do I Think Home Prices Will Go?

Pulsenomics’ Home Price Expectation study – a study of over one hundred economists, real estate specialists, investment and market strategists – is one reputable source of that information.

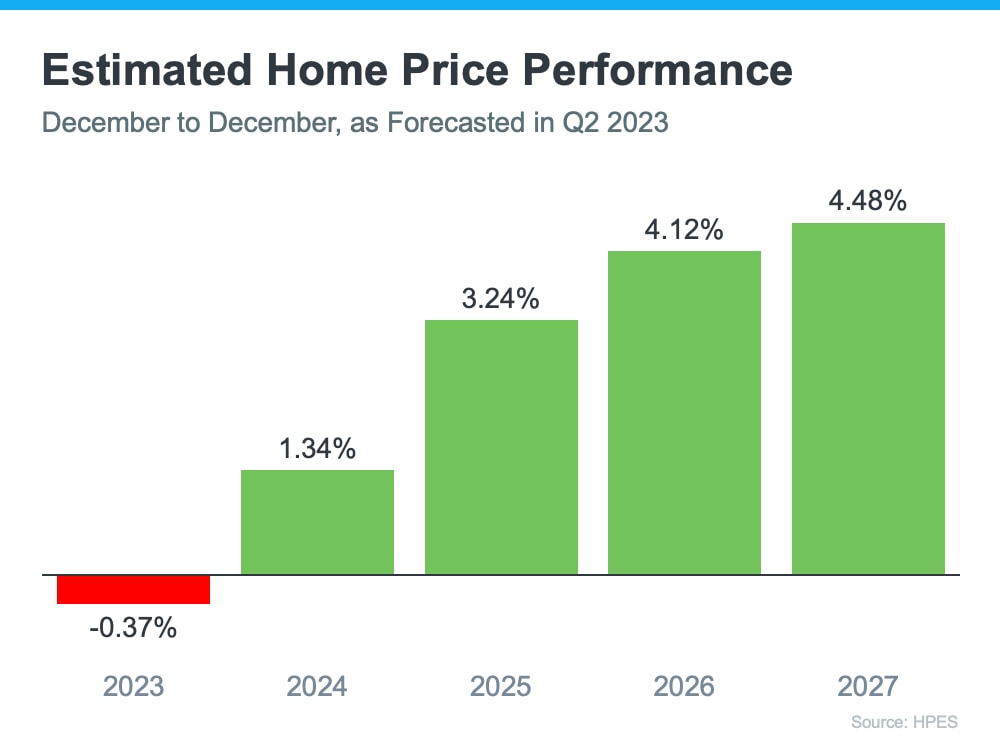

According to the most recent release, the experts polled predict a small depreciation this year (see red in the graph below). But here’s the most important context. The worst of the home price drops are now behind us, and prices are beginning to rise again in many cities. Not to mention, the 0.37% depreciation shown by HPES for 2023 is far from the crash that some predicted would occur.

Let’s turn our attention to the future. The green in the graph below indicates that prices have turned a corner and will rise in 2024 and beyond. The HPES predicts that after this year, home price appreciation will return to more average levels for the next several years.

So, why is this important to you? It means that your home’s worth will likely rise and you will build equity in the years ahead, but only if you buy now. Based on these projections, waiting will only cost you more money in the long run.

Where Do I Think Mortgage Rates Will Go?

Mortgage rates have risen in response to economic uncertainty, inflation, and other factors over the last year. According to the most recent reports, inflation, while still high, has slowed since its peak. This is a positive indicator for the market and mortgage rates. This is why.

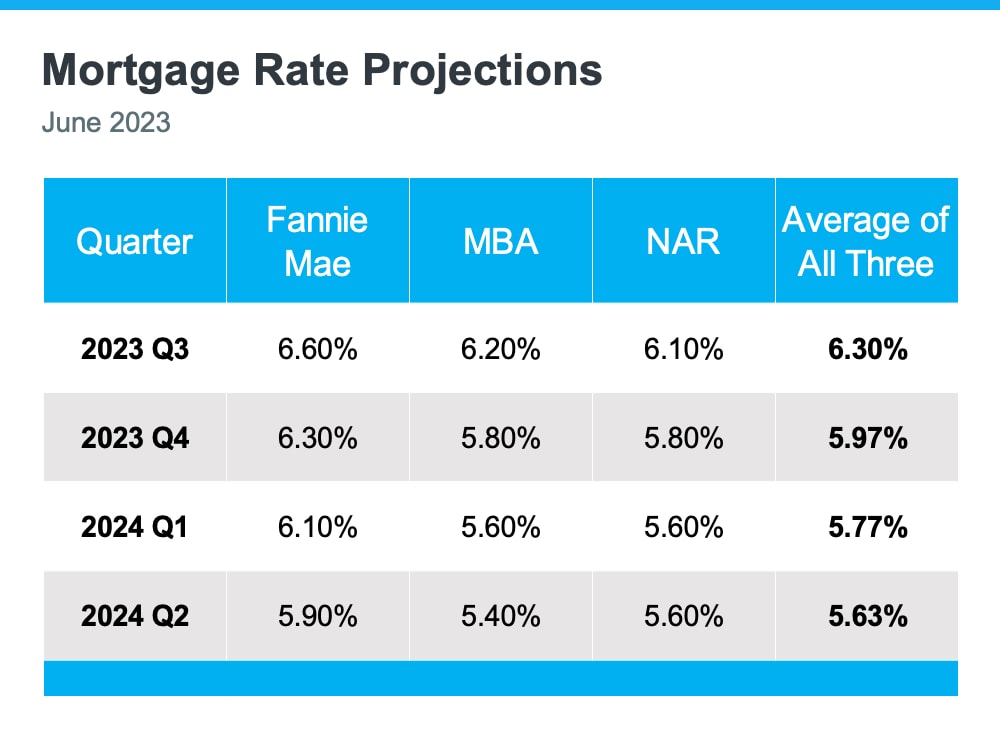

When inflation falls, mortgage rates tend to reduce as well. This could be why some analysts predict that mortgage rates will fall slightly over the following few quarters, settling somewhere between 5.5 and 6% on average, but that remains to be seen with rates now staying above 7% and may very well go to 8% or higher!

But no one, not even the experts, can predict where mortgage rates will be next year or even next month. This is because there are so many variables that might influence what happens. So, to give you a glimpse of the potential outcomes, consider the following:

- If you buy now and mortgage rates do not change: You made a solid decision because home prices are expected to rise over time, so you beat rising prices.

- If you buy now and mortgage rates fall (as predicted): you will have made a good decision because you bought before home prices increased. You can always refinance your house later IF interest rates fall.

- If you buy now and mortgage rates rise: If this occurs, you made an excellent decision because you purchased before both the price of the home and the mortgage rate rose.

Summing It Up

If you’re considering buying a house, you should be aware of the current state of housing prices and mortgage rates. While no one can predict where they will go, real estate professionals can provide you with useful information to keep you informed. If you’re considering buying a home in Cobb County or the Metro Atlanta area and have questions just get in touch – (404) 410-6465 or visit Complete Realty Team to contact us by email.

Original post here: Where Are Home Prices Headed? Should You Buy A Home Now Or Wait?

No comments:

Post a Comment