Monday, November 6, 2023

Sunday, November 5, 2023

U.S. Mortgage Originations Predicted to Hit $1.95 Trillion in 2024

The Mortgage Bankers Association is expecting a 19% increase in total mortgage origination volume by 2024, from 4.4 million loans in 2023. Mike Fratantoni, MBA's Chief Economist, predicts a mild recession in early 2024 due to higher interest rates, tighter credit conditions, and a depletion of pandemic-era savings. Despite the expected recession, the MBA expects the national housing prices to grow over the next three years due to tight inventory, with first-time homebuyers making up a large portion of housing demand.

Original post here: U.S. Mortgage Originations Predicted to Hit $1.95 Trillion in 2024

Friday, November 3, 2023

Could Mortgage Rates Come Down in 2024?

Mortgage rates have risen significantly in the past year, going from around 3% to nearly 8%, causing many potential home buyers to question when rates will drop again. Factors such as the Federal Reserve, inflation, supply and demand, and Federal Reserve monetary policy have all had an effect on mortgage rate movement. As of October 11, 2023, the average 30-year fixed mortgage rate is 7.83%, the highest it has been in over two decades; however, experts anticipate that rates will be lower by the end of 2024.

Original post here: Could Mortgage Rates Come Down in 2024?

Thursday, November 2, 2023

First-Time Buyers Decoding the 5 Cs of Credit

Capacity:

Lenders evaluate income and expenses to ensure repayment capability.

Original post here: First-Time Buyers Decoding the 5 Cs of Credit

Wednesday, November 1, 2023

The Connection Between Mortgage Rates And Inflation

Mortgage Rates and Inflation: Past, Present, and the Future

If you want to buy a house this year, you’re probably keeping a close eye on mortgage rates. Because mortgage rates influence what you can afford when you take out a home loan – and affordability is such a big concern right now – it’s a good time to look at where mortgage rates have been historically compared to where they are currently. Aside from that, understanding their link with inflation might provide insight into where mortgage rates may go in the near future.

Mortgage Rates In The Past

Since April 1971, Freddie Mac has been tracking the 30-year fixed mortgage rate. They publish the findings of their Primary Mortgage Market Survey every week, which averages mortgage application data from lenders across the country (see graph below):

Mortgage rates have risen dramatically since the beginning of last year, as shown on the right side of the graph. Even with that increase, today’s rates are still lower than the 52-year average. While that historical perspective is useful, purchasers have become accustomed to mortgage rates ranging between 3% and 5%, which has been the case for the past 15 years.

This is significant because it explains why the recent increase in rates may have you feeling sticker shock despite the fact that they are close to their long-term average. While many buyers have adjusted to higher rates over the last year, a somewhat lower mortgage rate would be appreciated amongst buyers. In order to establish whether it is a feasible prospect, inflation must be considered.

Where Might Mortgage Interest Rates Go in the Future?

Since early 2022, the Federal Reserve has been working hard to reduce inflation. This is crucial since there has historically been a link between inflation and mortgage rates (see graph below):

This graph depicts a very consistent relationship between inflation and mortgage rates. Looking at the left side of the graph, you can see that if inflation changes significantly (shown in blue), mortgage rates follow suit quickly (shown in green).

The circled area on the graph represents the most recent surge in inflation, with mortgage rates close behind. While inflation has slowed slightly this year, mortgage rates have yet to follow suit.

That is, if history is any indicator, the market is expecting mortgage rates to follow inflation and fall. It is impossible to anticipate where mortgage rates will go with certainty, but with inflation decreasing, mortgage rates falling in the near future would fit a well-established trend.

Summing It Up

It’s useful to look at where mortgage rates have been in the past to get a sense of where they might go in the future. There is a clear relationship between inflation and mortgage rates, and if that historical pattern remains true, the recent decrease in inflation may be excellent news for mortgage rates and your homeownership objectives in the future. If you are looking to buy or sell a home in Cobb County or the Metro Atlanta area, just get in touch! We’d be more than happy to answer any of your questions! You can reach us at (404) 410-6465 or visit Complete Realty Team and get in touch by email. Until next time!

Original post here: The Connection Between Mortgage Rates And Inflation

Tuesday, October 31, 2023

Daily mortgage rates for October 10, 2023: Rates slightly increase

Mortgage rates are trending high across the board, with the current 30-year fixed rate being 8.16%, 15-year fixed rate being 7.24%, and 30-year jumbo rate being 8.07%. These rates are significantly higher than last year's, with the 30-year fixed rate being 5.70% and the 15-year fixed rate being 5.00%. Mortgage rates are determined by the overall economy, inflation, and actions of the Federal Reserve.

Original post here: Daily mortgage rates for October 10, 2023: Rates slightly increase

Happy Halloween

Halloween falls on October 31 because the ancient Gaelic festival of Samhain, considered the earliest known root of Halloween, occurred on this day.

In the eighth century, Pope Gregory III designated November 1 as a time to praise all saints.

Soon, All Saints' Day incorporated some traditions of Samhain and the evening before was known as All Hallows Eve, and later Halloween.

Over time, Halloween evolved into a day of activities like trick-or-treating, carving jack-o-lanterns, festive gatherings, donning costumes and eating treats.

Today’s the day to eat candies and sweets to your heart’s content! Happy Halloween!

Original post here: Happy Halloween

Monday, October 30, 2023

Georgia to Open Waitlist for Housing Choice Voucher Program

The Georgia Department of Community Affairs is opening applications for the Housing Choice Voucher Program.

This program, funded by HUD, aims to assist low-income families and individuals in obtaining safe and sanitary housing.

Eligibility for the program is based on factors such as total annual gross income, family size, and immigration status.

Original post here: Georgia to Open Waitlist for Housing Choice Voucher Program

Saturday, October 28, 2023

Georgia rental assistance program to reopen applications | What to know

The Housing Choice Voucher Program in Georgia will open its applications for the waitlist for three days in October, allowing families who need assistance covering their rent to apply. A lottery system will be used to select who will be added to the waitlist and those selected will be randomly placed on the list to get a housing voucher. The Department of Community Affairs is also looking for renters to join the program which can be done online.

Original post here: Georgia rental assistance program to reopen applications | What to know

Friday, October 27, 2023

Should you consider an adjustable-rate mortgage?

With mortgage rates at 7.67%, buying a home may not be the most financially viable option. The Mortgage Bankers Association reports that while the average 30-year fixed rate mortgage is at a high, the rate on the average 5-year adjustable-rate mortgage (ARM) actually went down to 6.33%. This has caused a surge in ARM applications, and is the highest since November 2022. Real estate experts explain the current housing shortage in part by pointing to baby boomers who are staying in their homes longer and a decrease in homebuilding activity. For those looking to buy now, the ARM may be the best option,

Original post here: Should you consider an adjustable-rate mortgage?

Thursday, October 26, 2023

Should You Buy Now and Refinance Later

Investors should focus on property value over interest rates.

Original post here: Should You Buy Now and Refinance Later

Wednesday, October 25, 2023

Saving Money on Property Taxes: Tips and Process

The first step in ensuring you pay the correct property tax amount is to file for exemptions.

Original post here: Saving Money on Property Taxes: Tips and Process

Tuesday, October 24, 2023

September 2023 Housing Market Trends Report

The housing market in September showed a decrease in actively listed homes, newly listed homes, and total unsold homes compared to last year. However, the median price of homes for sale increased slightly, and the inventory of homes for sale increased from August. Despite this, total listings were still 12.2% lower than the same time last year, leaving buyers to contend with higher listing prices, mortgage rates, and lower inventory.

Original post here: September 2023 Housing Market Trends Report

REALTOR® Ken Mandich Weighs In On The Return Of ARMs And Their Effect On The Housing Market

Ken Mandich from Complete Realty Team has published a new blog post and YouTube video discussing the recent rise of adjustable-rate mortgages (ARMs) and whether they can be a good choice for some homeowners.

Adjustable-rate mortgages were extremely popular at the beginning of the 21st century. Notably, many experts believe that their popularity was in part responsible for the 2008 housing market crisis. However, today, after many years of inactivity, homebuyers are being presented with the option of going for adjustable-rate mortgages again for their home purchases.

Ken describes the benefits of ARMs by saying, “With an adjustable-rate mortgage, homeowners make lower monthly payments at the beginning and the rate goes up several years into the duration of the mortgage. This helps homebuyers to get started with their dream of homeownership with favorable rates with an expectation that their income will keep up with the increased rates in the future.”

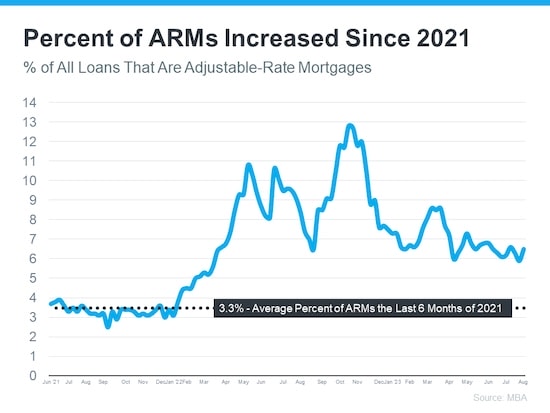

According to statistics from the Mortgage Bankers Association (MBA), in the last 6 months of 2021, around 3.3% of all mortgages issued in the United States were adjustable-rate mortgages. There was a spike in the number of ARMs approved in 2022 with the number finally settling to around 6.5% in the first half of 2023.

Ken talks about the reasons why ARMs have a slight uptick by saying, “It’s simple. Mortgage rates have increased considerably in the last year. With rising rates, several homeowners chose ARMs since standard prices were high and they provided them with a lower rate.”

Despite ARMs being very popular for many homeowners, this resurgence may have also evoked flashbacks to the 2008 crisis. However, the banks and mortgage providers have learned their lessons and are being more selective of who qualifies for ARMs. In the early 2000s, banks and mortgage providers were playing fast and loose with the rules. On the other hand, today, they are seeking verification of employment, assets, incomes, and so forth to make their decisions.

“I realize that ARMs get a bad rap as they conjure up images of the 2008 subprime mortgage crisis that destroyed millions of lives across the nation,” says Ken Mandich. “This time, things are different. Back then, mortgage providers were callous in their conduct and offered mortgages to pretty much anyone who applied. Today, they are doing their due diligence and asking for the right documentation as proof to ensure their customers have the ability to pay off their mortgages in the future. So, there is no fear of ARMs causing another housing crash.”

Ken Mandich, who has called the North Metro area home for over 30 years now, has over a decade of experience being a real estate investor and house flipper. As a REALTOR® and part of the ERA Sunrise team, Ken Mandich helps his clients get straight answers to their questions and delivers proven results. He is intimately familiar with the real estate market in Cobb County and the metro Atlanta area and can help his clients with everything from downsizing, relocating, selling, buying, investing, or even buying their first home in Georgia.

Ken and Complete Realty Team help clients with every step of the real estate transaction process including comparable home price analysis, open houses, property surveys, HOA agreements, credit reports, title companies, lenders, homeowners’ insurance, walk-throughs, terms of sale or purchase, concessions, repairs, and closing documents.

“Our ERA team’s innovative marketing strategies, negotiation skills, and local market knowledge have allowed us to consistently help our clients sell their property for top market value as quickly as possible, as well as help buyers find their perfect dream home or investment property. So, if you are ready to buy a home in Cobb County, give me and my team a call today,” says Ken Mandich.

https://www.youtube.com/watch?v=P_MFXXdhBpA

Readers can contact Ken Mandich at (404) 410-6465 or admin@completerealtyteam.com to get started with finding and moving into their dream property in Cobb County and the Metro Atlanta area. For more real estate news, homebuyers and homeowners are urged to follow his YouTube channel.

Source: REALTOR® Ken Mandich Weighs In On The Return Of ARMs And Their Effect On The Housing Market

Monday, October 23, 2023

Georgia’s Mid-Q3 Housing Updates

Mid-Q3 saw a slowdown in Real Estate activity, while the housing market experienced rising prices and decreasing inventorySales and Inventory:

New Listings: ↓7% to 16,054

Pending Sales: ↓15% to 10,640

Closed Sales: ↓12% to 11,468

Inventoary: ↓4% to 27,387

Prices and Days on Market:

Median Sales Price: ↑3% to $356,688

Average Sales Price: ↑6% to $427,639

Days on Market: 35

Original post here: Georgia’s Mid-Q3 Housing Updates

Sunday, October 22, 2023

US 30-Year Mortgage Rate Tops 7.5% for First Time Since 2000

Last week, US mortgage rates topped 7.5%, the most since mid-August, and applications for home purchases tumbled to a multi-decade low. This illustrates the battered housing market, caused by aggressive interest-rate hikes by the Federal Reserve, soaring bond yields, and rising mortgage rates and home prices. This has created one of the most unaffordable housing markets on record. The Federal Reserve is likely to keep interest rates elevated for the foreseeable future to tame inflation.

Original post here: US 30-Year Mortgage Rate Tops 7.5% for First Time Since 2000

Saturday, October 21, 2023

Three Mortgage Averages Sitting at Record Highs

Mortgage rates have recently hit a two-decade high, with the 30-year fixed-rate average at 7.87%, the 15-year rate average at 7.18%, and the jumbo 30-year rate at 7.15%. It is important to shop around for the best mortgage option and compare rates regularly, as refinancing rates have moved differently from new purchase rates.

Original post here: Three Mortgage Averages Sitting at Record Highs

Thursday, October 19, 2023

Tips for Getting a Home Inspection in Georgia

Home inspections are crucial in Georgia to assess a property's condition, uncover potential issues, and negotiate repairs or credits.Specialized inspections like radon testing and sewer scopes are recommended, especially in areas with elevated radon levels.

Home inspections are not required in Georgia but are highly recommended, and it's wise to hire licensed and certified inspectors.a

Original post here: Tips for Getting a Home Inspection in Georgia

Wednesday, October 18, 2023

Georgia: No Crash in Sight, Stability Expected

Experts generally rule out a housing market crash in Georgia.

Fewer new listings and closed sales indicate a cooling market.

High demand continues to push prices upward.

Original post here: Georgia: No Crash in Sight, Stability Expected

Monday, October 16, 2023

The Return Of The Adjustable Rate Mortgage

Should You Be Concerned About the Reintroduction of Adjustable-Rate Mortgages?

If you recall the 2008 housing meltdown, you may recall how popular adjustable-rate mortgages, (also known as an ARM). And, after years of being nearly nonexistent, ARMs are becoming increasingly popular when buying a home. Let’s look at why this is happening and why it’s not a cause for alarm.

Why Have ARMs Become More Popular Recently?

This graph uses Mortgage Bankers Association (MBA) data to demonstrate how the share of adjustable-rate mortgages has increased in recent years:

As shown in the data, after hovering around 3% of all mortgages in 2021, many more homeowners switched back to adjustable-rate mortgages last year. That growth has a straightforward reason. Mortgage rates increased considerably last year. With rising borrowing rates, several homeowners chose this sort of loan since standard borrowing prices were high, and an ARM provided them with a lower rate.

Why Are Today’s ARMs Not The Same As Those In ’08?

To put things into perspective, keep in mind that these aren’t the ARMs that were popular in the run-up to 2008. Loose lending rules contributed to the housing meltdown. When a buyer obtained an ARM, banks and lenders did not check verification of employment, assets, income, and so forth, people could get a loan without having to prove anything! Essentially, people were receiving loans that they should not have received. Many homeowners were put in jeopardy as a result of their inability to repay loans for which they were never required to qualify in the first place.

Lending requirements are different this time. Banks and lenders learned from the crash, and they now verify income, assets, employment, and other information. This implies that today’s buyers must qualify for their loans and demonstrate their ability to repay them.

CoreLogic Economist Archana Pradhan outlines the difference between then and now:

“Around 60% of Adjustable-Rate Mortgages (ARM) that were originated in 2007 were low- or no-documentation loans . . . Similarly, in 2005, 29% of ARM borrowers had credit scores below 640 . . . Currently, almost all conventional loans, including both ARMs and Fixed-Rate Mortgages, require full documentation, are amortized, and are made to borrowers with credit scores above 640.”

In plain terms, Laurie Goodman of the Urban Institute emphasizes this idea by saying:

“Today’s Adjustable-Rate Mortgages are no riskier than other mortgage products and their lower monthly payments could increase access to homeownership for more potential buyers.”

Summing It Up

If you’re concerned that today’s adjustable-rate mortgages will be similar to those used during the housing meltdown, rest assured that things are different this time. If you have questions about buying or selling a home in the Metro Atlanta area, we’d be more than happy to help! Just reach out to us at (404) 410-6465 or visit Complete Realty Team. We look forward to speaking with you!

Original post here: The Return Of The Adjustable Rate Mortgage

Market Predictions for Late-2023: Still Competitive

The housing market is expected to remain competitive by End-2023.

Original post here: Market Predictions for Late-2023: Still Competitive

Saturday, October 14, 2023

3 Housing Market Predictions for October 2023

The housing market in October is not looking any different from the current market, with mortgage rates remaining high and limited inventory. Home prices are also expected to continue to rise, making it even more difficult for buyers to afford. However, despite the challenge, it is still possible to buy a home in October.

Original post here: 3 Housing Market Predictions for October 2023

Thursday, October 12, 2023

Cons of Selling Your House FSBO

FSBO involves a series of steps that homeowners need to undertake independently.

FSBO is time-consuming, involving market analysis, home staging, marketing, negotiation, and legal tasks.Lack of Real Estate knowledge can lead to costly errors in understanding market trends, laws, and negotiation tactics.

Original post here: Cons of Selling Your House FSBO

Georgia Fights Property Tax Surge: Capping vs. Exempting

Home values in Georgia have surged, leading property taxes to ↑ 41% since 2018. Lawmakers are proposing solutions: 1. Senate: – Cap an...

-

Buying a home can be intimidating, especially in a hot housing market. Before starting to shop for a home, it's important to know how m...

-

Home values in Georgia have surged, leading property taxes to ↑ 41% since 2018. Lawmakers are proposing solutions: 1. Senate: – Cap an...

-

Building a home in Georgia averages $136/sq ft, ranging $100K-$400K+, depending on factors. DIY home building is feasible in Georgia, in...