Is Fewer Homes For Sale Good News For Sellers?

Even if the housing market has calmed from the frenzy of the ‘unicorn’ years, it remains a seller’s market due to the scarcity of available properties. But what does this mean for you? And why are conditions so favorable today if you want to sell your home?

According to the National Association of Realtors’ (NAR) most recent Existing Home Sales Report, housing supply remains astoundingly low. The quantity of available properties on the market is used to calculate housing inventory. It is also quantified in months’ supply, which is the number of months required to sell all available properties based on current demand. A six-month supply is typical in a balanced market. At the present sales rate, we only have roughly 3 months’ supply of homes or less in some areas (see graph below):

Given the existing availability of properties, it’s still a seller’s market, as the graph illustrates.

We’re still a long way from having a balanced market. In reality, the current months’ supply is half of what a normal market would have. Based on current buyer demand, this indicates there simply aren’t enough properties to go around.

According to Lawrence Yun, NAR’s Chief Economist:

“There are simply not enough homes for sale. The market can easily absorb a doubling of inventory.”

What Are the Advantages of Being in a Seller’s Market?

Sellers, these conditions provide you a significant advantage. There are home buyers chomping at the bit that are ready, willing, and able to buy a home right now. And, because there are fewer homes for sale, those that do come on the market act as magnets for those buyers.

If you enlist the help of a local real estate agent to market your house, that’s in good condition, and priced correctly, it could attract a lot of interest. You may even receive many offers!

But hold on! Are there more houses on the market?

If you’re debating whether or not you should sell your home, well, you may not have another great opportunity as this for quite some time, it’s one of the most significant advantages you have right now. When housing availability is this limited, your home will stand out, particularly if it is reasonably priced. We can’t overstress that enough. With interest rates being so high buyers are NOT willing to overpay for a home.

However, there are some early indications that additional listings are on the way. According to the most recent data, new listings (homeowners who have recently listed their home for sale) are on the rise. Here’s why this is significant and what it might mean for you.

There Are More Homes Being Listed For This Time Of Year

The spring buying season is well recognized to be the busiest time of year in the housing market. As a result, the number of newly listed residences increases predictably throughout the first half of the year. Sellers are bracing for this and preparing for the months when buyers are most active. However, when the school year begins and the holidays approach, the market cools. It’s to be anticipated.

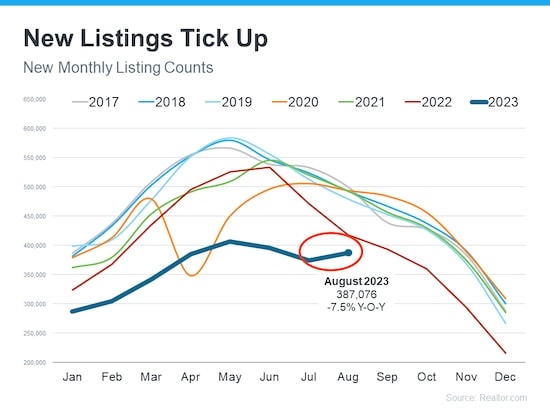

But here’s the surprising part. According to the most recent Realtor.com data, there is an uptick in the amount of sellers advertising their homes later this year than typical. A high this late in the season is unusual. In the graph below, you can observe both the normal seasonal tendency and the extraordinary August:

According to Realtor.com:

“While inventory continues to be in short supply, August witnessed an unusual uptick in newly listed homes compared to July, hopefully signaling a return in seller activity heading toward the fall season . . .”

While this is only one month of data, it is noteworthy. It’s still too early to tell if this trend will continue, but if it does, you’ll want to be prepared.

What Does This Mean for Home Sellers?

If you’ve been putting off selling your home, this could be the perfect time. That’s because, if this tendency continues, the longer you wait, the more competition you’ll face. If your neighbor also lists their property for sale, you may have to compete for the attention of buyers with that other homeowner. If you sell today, you will be able to outbid your neighbors.

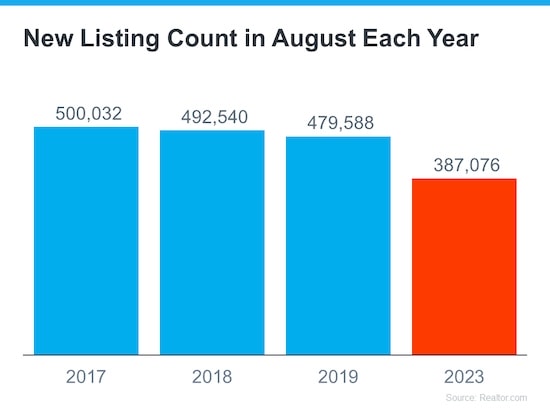

Even with more properties on the market, the market remains far below normal supply levels. And the inventory shortfall won’t fix itself overnight. The graph below helps put this into context, allowing you to realize the opportunities you still have right now:

Summing It Up

You don’t want to wait for more competition to appear in your community, even if inventory is currently low. If you sell your house now, you will still have a fantastic chance. Let’s talk about the advantages of selling now, before more houses hit the market. If you’re ready to sell your house, have questions about what it’s worth or any other questions, just give us a call. You can reach us at (404) 410-6465 or visit Complete Realty Team. We look forward to hearing from you!

Original post here: Is A Lack Of Inventory Good For Sellers? Is It A Good Time To Sell?