Marietta, GA based Complete Realty Team (CRT) is offering their community professional assistance with all their real estate needs. As their name suggests, the agency specializes in providing a personalized service that encompasses every aspect of a client’s real estate concerns. Learn more here: Agent Near Me.

Marietta, GA based Complete Realty Team (CRT) is offering their community professional assistance with all their real estate needs. As their name suggests, the agency specializes in providing a personalized service that encompasses every aspect of a client’s real estate concerns. Learn more here: Agent Near Me.

CRT’s foremost commitment is to their client, and their team has a wealth of experience working with people with varying degrees of exposure to the real estate industry. As such, they are capable of either executing plans fluidly in accordance with a client’s wishes or providing a host of options in the event the client requires more assistance. In the latter situation, Complete Realty Team also endeavors to give them all the context they need in order to make informed decisions that best suit their interests.

“If you want to sell or buy a property in Cobb County,” the agency says, “your best course of action would be to come to us. You will find our team’s assistance to be of immense value no matter how many homes you have bought or sold in the past because we implement state-of-the-art technology at every possible junction to give ourselves and our clients an edge. Further, we understand the value of the human touch, and you can always expect us to be willing to have a frank discussion with you regarding your options.”

Complete Realty Team is headed by REALTOR® Ken Mandich, who originally got into the industry by renovating and selling homes. His extensive experience in this regard means that he can now identify and track market trends with relative ease, a skill he had to perfect long ago as an independent investor. He has also personally been involved in closing deals throughout his career, and he now plies this expertise on behalf of the agency’s clients.

With Mandich’s guidance, the team is able to work with clients from virtually any background, and they begin every relationship by taking the time to understand what the client is hoping to achieve. Whatever their priorities may be, CRT will adopt them as their own, be they speed, profit or even a hassle-free experience.

“We don’t chase short-term goals,” the agency explains, “we strive to build long-term relationships. Much of our business is based on referrals and returning clients as a result, and we are exceptionally proud of this fact. Our community has come to recognize that we truly have their best interests at heart, and they can rely on us to aggressively help them achieve the outcomes they desire.”

Mandich has also invested heavily in broadening his team’s knowledge of digital marketing. An unfortunate number of real estate agents, CRT says, still rely solely on the Multiple Listing Service (MLS) to get their client’s property on the market, but this is far from the only reliable method to do so. In fact, with the right leverage, social media can often prove a far more capable tool. Complete Realty Team says their objective here is simply to find a serious buyer, and they will utilize every means at their disposal to do so.

In fact, homeowners who are looking to make a sale in the near future can get started by simply visiting the CRT website. After submitting a few details about the property on the agency’s Sell page, they will receive an estimated value for their property in less than 24 hours. While this figure is in no way intended to be completely accurate, it often serves as an educational ballpark estimate for those who want to consider their options. For a more accurate figure, the client need only get in touch with the team directly, and their agents will take over from there. A similarly simple mechanism can be found on the agency’s Buy page as well.

Anyone looking for a REALTOR® in Marietta who can simplify the real estate process needs to look no further than Complete Realty Team. Buyers, sellers, and other interested parties are invited to get in touch with Ken Mandich or another member of the CRT team to inquire further about their services.

Source: Complete Realty Team: How A Realtor Can Help You

Ken Mandich from Complete Realty Team is helping Cobb County, Georgia, residents understand the difference between a real estate agent and a

Ken Mandich from Complete Realty Team is helping Cobb County, Georgia, residents understand the difference between a real estate agent and a

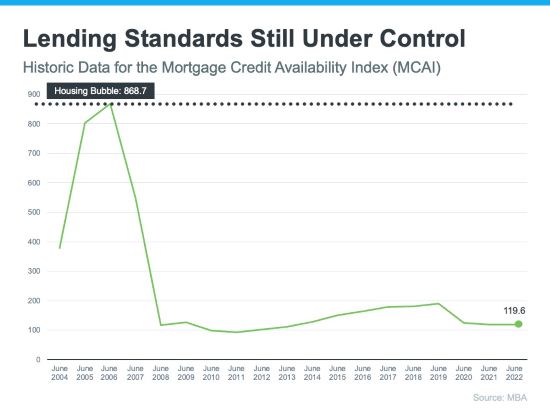

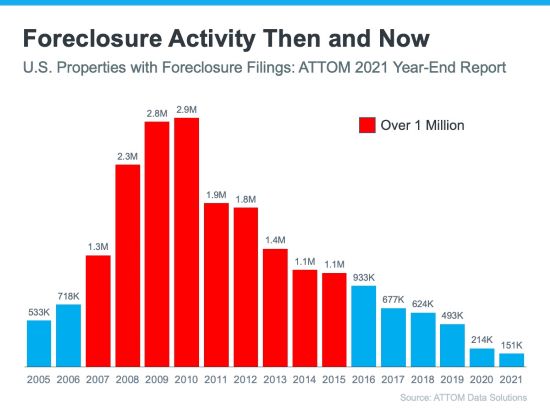

Ken Mandich, a real estate agent from Cobb County, Georgia, is easing fears that the current housing market is headed for a crash similar to the one in 2008.

Ken Mandich, a real estate agent from Cobb County, Georgia, is easing fears that the current housing market is headed for a crash similar to the one in 2008.